How Big Is the Marriage Tax? Now We Know

I have long known that there are government penalties for marriage but the report below shows how extensive that is. A big one not mentioned below is when a lady with children marries.

She will often be in receipt of substantial welfare payments and loses all that when she marries. And that is particularly bad when the man involved is making child support payments to an ex-wife. Re-marriage simply makes the relationship unviable. The welfare payments are needed to balance out the support payments

Governments know of that and endeavour to get around it by treating de facto marriages the same as legal mariages. So the couple still lose the welfare payments even if they are only living together. To enforce that, some government employ "dole sniffers" -- people who go around looking into people's relationships to see if they qualify as de facto marriages.

But people get around that too. I once owned a boarding house where men rented a room from me just so they could have a different address from their lady. And if dole sniffers were around they would even spend the required number of nights in the room to qualify themselves as single

I married 4 times but I was well-off enough not to be bothered by the welfare benefit situation and other disincentives. Many people are not so lucky.

And a really big marriage disincentive -- one that affects most men -- is the divorce laws. Divorce can be economically ruinous to a man so to avoid that it is best not to marry at all. There are many de facto marriages for that reason. I always married nice ladies so my divorces cost me little. One wife did not have a car so I gave her my car when we split and she was happy with that. I wanted a new car anyway.

And one lady was richer than I was. Some men aspire to marry a millionairess. I divorced one! I guess I have had a "colourful" life

Economists, tax specialists and even ordinary people have long known that public policies can make marriage very unattractive. At the lower end of the income spectrum, marriage can lead to a significant loss of entitlement benefits. At the high end, couples who marry may face substantially higher income taxes.

There are many reasons to care about this. Academic studies find that marriage stabilizes relationships, improves children’s outcomes and facilitates the development of labor market skills for the adults. In general, marriage is correlated with economic well-being. One study reports that married couples’ average per capita wealth is more than twice that of the never-married.

Until recently researchers have not had the tools to fully measure the full extent of government-created marriage penalties. A new study by Boston University economist Laurence Kotlikoff and his colleagues gives us the most accurate estimate to date.

The study includes more than 30 different federal and state entitlement programs—all of which condition benefits on the beneficiaries’ incomes. In addition to federal income and payroll taxes, it includes the tax rates in the 50 states and the District of Columbia. And it includes the effects of marriage on such elderly entitlement benefits as Social Security and Medicare. No previous study comes close to this level of careful measurement.

One finding: young adults with low- or middle-income jobs pay a heavy price if they marry. When higher tax rates are combined with a reduction in welfare/entitlement benefits, the economic loss from marriage is equal to between one-and-a-half and two years of income, on average.

Take two people between the ages of 26 and 40:

If both individuals earn $10 an hour, getting married will lower their lifetime income by more than $70,000, on average.

If they earn $15 an hour, the lifetime losses will climb to more than $107,000.

At $20 an hour, their loss will be more than $142,00.

Note that these are only averages. Some couples face marriage burdens that are much higher. In the worst case researchers discovered, getting married has a lifetime cost that is equal to 20 years of income! This occurs when marriage makes a family’s income too high to qualify for Medicaid, but too low to qualify for an Obamacare subsidy in states that have not expanded Medicaid.

The marriage tax differs depending on where people live and what entitlement programs they enroll in. Programs such as Medicaid, for example, vary a lot from state to state in terms of eligibility and the generosity of benefits. To take one example, the overall marriage penalty in Hawaii is twice the size of the one in New Mexico.

One finding of the study is not very surprising: the marriage penalty affects low-income couples more than high-income couples. Take individuals with incomes between $26,000 and $40,000. On the average, they face a marriage tax rate that is more than twice the rate for the 20 percent of families with the highest incomes.

This is certainly part of the reason why only 36 percent of individuals with annual incomes below $26,000 are married, while the marriage rate for those with annual incomes above $103,100 is more than double that, at 77 percent.

For couples who earn $26,000 or less, the biggest components of the marriage tax are the potential loss of Medicaid and food stamps. These losses are partially offset by an actual gain from income tax credits and larger subsidies in the Obamacare health insurance exchanges.

For couples at higher income levels, the potential loss of Medicaid and food stamp benefits becomes less important, and the Obamacare subsidies begin to penalize marriage. For couples who earn more than $100,000, two-thirds of the marriage penalty is created by the tax law alone—because of the couple’s inability to file completely separate tax returns.

To make matters worse, the same fiscal system that creates a marriage penalty also imposes very high marginal tax rates on labor income, especially on people at the low end of the income spectrum. We are discouraging marriage and productive work at the same time with the same policies.

Is it possible to have a compassionate fiscal system that does not create these perverse incentives?

Replacing our income tax system with a flat tax or a national sales tax or a value added tax would eliminate the income tax part of the marriage penalty. Under such tax regimes, couples would have no tax reason to marry or divorce. At a minimum, couples should have an option of filing completely separate tax returns.

What about health care? Through the years there have been a number of proposals to replace all tax and spending health care subsidies with a fixed-sum tax credit for private insurance, regardless of personal income or marital status. For those who decline the opportunity, the credit amount would be sent to a local safety net and communities receiving these funds would be required to establish and provide safety-net care. The most recent bill is sponsored by Rep. Pete Sessions (R-TX).

We already make a great deal of food available to children in a way that avoids perverse incentives. Many large city school districts provide lunch and breakfast without charge to all students, regardless of income, and in the 2020-2021 school year, the federal government extended free meals to all students in every district.

Housing subsidies might be restructured in ways that do not involve an income or marriage test.

There are many good reasons not to get married. Government policies should not be among them.

https://www.independent.org/news/article.asp?id=14234&omhide=true&trk=rm

************************************************Why Prison Matters

Law enforcement and academics agree that three factors are involved in deterring crime: certainty of apprehension, swiftness of apprehension, and severity of sanctions—in other words, how likely you are to get caught, how quickly you get caught, and how long you spend in prison if you get caught.

The two groups disagree, however, about which of these is most important for deterrence. Modern academics insist that length of prison sentences is not crucial, while law enforcement officials believe that the length of incarceration time actually stops people from committing crimes in the future. In a recent report, the United States Sentencing Commission put this question through a rigorous statistical testing procedure involving thousands of inmates over multiple decades and came up with a clear result: length of incarceration matters for recidivism—a lot.

Academics take a negative view of stiff sentences. Some argue that longer sentences have no effect on recidivism. Other scholars argue that longer sentences are criminogenic—that is, they cause people to be more likely to commit crimes when they are released. Liberal advocacy groups claim that shorter sentences would actually reduce future offending. But a thorough review of the literature by separate groups of respected scholars in 2009 and 2022 concluded that much of the academic research regarding the effect of length of incarceration on recidivism suffered from serious methodological flaws, including too-small study sizes and ill-advised attempts to judge the impact of minor differences in incarceration.

The United States Sentencing Commission, using its access to massive amounts of data about thousands of federal criminal defendants over many decades, decided to test the effects of incarceration on recidivism. The commission chose to study 32,135 federal criminal defendants released in 2010. The study divided the defendants into five groups based on length of sentence: 24–36 months, 36–48 months, 48–60 months, 60–120 months, and more than 120 months. The commission then checked to see which of the released defendants committed new crimes during an eight-year follow-up period.

The results were compelling. For defendants receiving a sentence of more than 60 months (five years), the odds of recidivism were 18 percent lower than a matched group of prisoners receiving shorter sentences. For defendants with sentences of more than 120 months (ten years), the odds of recidivism were 29 percent lower. These conclusions were statistically significant at p<0.001—a statistical measure that shows profound reliability. No statistically significant difference in recidivism was found for defendants serving less than 60 months.

Contrary to current academic thinking, then, the length of a criminal’s sentence matters quite a bit in reducing future offending. Why are these findings so important? First, because they offer a stern rebuttal to the academic literature downplaying the effect of lengthy sentences; the commission even devotes an entire section of its report to assessing these studies. But perhaps more importantly, the commission’s findings are a blow to progressive prosecutors, who have been relying on flawed academic literature to push for lower sentences for just about every crime, even violent ones, claiming that reduced sentences will not cause more crime.

One of the main proponents of this philosophy is Philadelphia district attorney Larry Krasner, who specifically criticized sentences longer than five years, promised that crime would drop if he avoided lengthy sentences, and scoffed at law enforcement officials who warned him of the consequences if he enacted his policies. Krasner delivered on his promises, dropping murder charges even in the case of video evidence and handing out lenient sentences. The predictable result: violent criminals have overrun Philadelphia, with murder soaring to an all-time record and police officers shot during a Fourth of July celebration.

This isn’t the first time that the Sentencing Commission has looked at the link between sentence length and recidivism. In a prior study of inmates released in 2005, the commission found substantively similar results. It redid the study in 2022 with inmates released in 2010 to address criticisms by public defenders of the first study. In the world of statistics, this is known as the replication of a study. Consistent results with new data suggest strongly that both studies are valid.

To summarize: lengthy prison sentences play an important role in stopping criminals from reoffending. When experts talk about deterrence being built on certainty, swiftness, and severity of sanctions, they need to recognize that all three factors work together to stop crime. As even the commission’s study found, relatively light sentences of less than 60 months don’t do much to stop defendants from committing crimes again, while longer sentences have a much better chance of success.

One final aspect of this study bears mentioning: the commission’s report linking longer sentences to less crime came out under the Biden administration. Like Bill Clinton in the 1990s, even Joe Biden’s own experts are telling him that longer sentences help curtail crime. Clinton listened, enacting tough-on-crime legislation in conjunction with a Republican-controlled Congress—and crime declined for decades. Now violent crime is surging again. Will Biden follow the data?

https://www.city-journal.org/why-incarceration-matters

*************************************************Boris Johnson is irreplaceable

It has been less than a fortnight since Boris Johnson’s premiership exploded so spectacularly just three short years after his triumphant election victory, and he became the latest Tory PM to perish at the hands of his own party. Yet two weeks on, the people who brought him down are already wondering if they hit the right man and what, or who, on Earth will follow him.

This outbreak of assassins’ remorse is scarcely surprising given the parade of political pygmies and snake oil salespeople who have been demonstrating their dubious wares on our TV screens in recent days. The sad truth is that for all his manifold faults and flaws Boris Johnson is irreplaceable. None of his would-be heirs come remotely close to matching his charisma, his unquenchable optimism, and his can do, hands on attitude to solving the serious problems that confront us.

As Johnson’s 16th century fellow Etonian the Elizabethan courtier John Harington famously remarked: ‘Treason never prospers. What’s the reason? For if it prospers none dare call it treason’. As the Tory traitors who took down Boris struggle unconvincingly to simultaneously praise and distance themselves from the man they knifed, an appalled public looks on at their antics. They may well conclude that these Boris’s betrayers are the last people to sort out the mess that they themselves have created.

As Boris Johnson himself leaves the stage – at least temporarily – whose limelight he has hogged so dramatically for the past decade, it is worth considering the qualities that propelled this unlikely figure to the forefront. Do those who took out Boris realise the damage they have done to the Tories’ reputation for competence and good governance?

Boris Johnson appealed to large chunks of the electorate not because of his transparent lack of honesty, integrity, and appetite for detail, but because he stood out from the crowd of grey men and women who populate politics as refreshingly, daringly different. Here was a guy who the average Joe could imagine sinking pints and having a laugh with. A bloke who had met the many self-inflicted setbacks and gaffes of his own life with that bounce back humour and resilience that people could identify with.

It is a myth that all previous prime ministers have been upstanding pillars of rectitude and seriousness. Many, such as Benjamin Disraeli, David Lloyd George, and Boris’s hero Winston Churchill, have been chancers in Boris’s own mould; colourful characters who have habitually lied – or in Churchill’s words told ‘terminological inexactidudes’ – in order to pursue their goals. For, as Churchill also observed, ‘truth is so precious that she always has to be attended by a bodyguard of lies.’

The foibles of their private lives did not prevent Disraeli from creating the modern Tory party, or stop Lloyd George and Churchill from founding the early welfare state and winning the two world wars. In the long perspective of history, posterity could remember Johnson more kindly for achieving Brexit, rolling out the Covid vaccination programme, and standing stalwartly behind Ukraine’s fight for freedom than for attending a few parties at the height of the pandemic.

In over-reacting to the jolly japester’s personal goofs and gaffes and under-valuing him getting the big calls right, Johnson’s Tory colleagues may have made the biggest error since their forebears overthrew the equally larger than life and controversial Margaret Thatcher with ultimately disastrous consequences. As the candidates vying to replace Johnson tear increasingly bloody lumps out of each other the only people to profit and prosper from their foolish act of treason will be Keir Starmer’s equally woeful Labour party.

https://spectator.com.au/2022/07/boris-johnson-is-irreplaceable/

***************************************Australian socialism has arrived

It has taken roughly sixty years for Australians to succumb to the socialist yoke, but now, the evidence is all around. Only governments with a socialist mindset could contemplate $25 million for an indigenous flagpole or, countenance citizens waiting three months for a passport. Or establish a costly in-house public servant Harmony Council, a Rainbow Connection team and, a dedicated LGBTIQ unit, let alone sanction a school curriculum which indoctrinates students to believe their nation and its institutions are illegitimate.

And only meddling central planners could impose the rigidities and distortions which have led to Australia’s soaring energy prices and unreliable supplies. As the crisis unfolds, socialism’s fatal conceit demands market failure is responsible. The architects are never to blame.

The application of the yoke was gentle at first with infinite promises of prosperity, greater equality, and accountable government. But, despite promises, per capita economic growth over the past decade has slipped to its slowest pace in 60 years. And, rather than deliver equality, a recent Productivity Commission report found the wealth of the top 20 per cent of Australians has grown 68 per cent in the past 15 years compared to six per cent for the bottom 20 per cent.

Australia’s public service has been a major beneficiary. A decade ago, it represented 15 percent of the labour force. Today it directly employs over two million people or, 17 percent of all jobs. Public sector wage growth has outstripped the private sector 2.5 times, and, on average, government employees enjoy a shorter work week and greater workplace flexibility than the private sector which pays for it.

It’s hardly surprising. When both sides of politics are dedicated to passing more and more restrictive laws and regulations, many with criminal sanctions, extra public servants are hired to administer them. And so, power from the private sector is subtly transferred to a growing army of self-serving, unaccountable, politically active, bureaucrats who have quickly exerted their authority. This reality was graphically on display when Victoria’s ideologically driven police fired rubber bullets, at peaceful demonstrators protesting the world’s longest lockdown. This contempt for liberty saw a pregnant mother at home with her infant children, forcefully handcuffed for posting a politically unwelcome message on her Facebook page. These and countless other abuses of power, sent a clear message that government is free to do anything it pleases, while the people may act only by permission.

As appalling as the Victorian government’s actions were, so too was the silence of Prime Minister Scott Morrison, the political class in general, big business and big media. It was left to the outside world to express amazement and disgust.

Aside from losses of freedom, Australia’s clumsy lockdowns have left massive government debts, lost childhood education, a surge in mental illness and, an increase in serious cancer cases due to delayed diagnoses. These are accepted as unintended consequences. After all, governments along with their health ‘experts’ and media allies, have too much political capital invested in mandates to ever admit fault. Best to ignore once-mocked Sweden which refused to impose lockdowns and, has one of the lowest mortality rates in Europe and, fewer ongoing health and economic issues.

Winston Churchill was right. ‘Nothing’, he wrote, ‘would be more fatal than for the government of states to get into the hands of the experts. Expert knowledge is limited knowledge: and the unlimited ignorance of the plain man who only knows what hurts, is a safer guide than any vigorous direction of a specialised character.’

Despite Churchill’s warning, today’s political class is in the hands of experts. It hides behind them when convenient and defers to them on measures to control the behaviour of the ‘plain man’. Facial recognition is already in service. There is an app to measure personal emissions and, central banks are considering digital currencies which can monitor everything we do. A Chinese-style social credit system seems just around the corner. Under this new socialist order, there is close collaboration between big government and big business. Profits now give way to environmental, social and governance criteria. Directors are accountable to different standards and must reflect gender ‘diversity’. Wealth generation increasingly depends on government patronage and central bank largesse. Careers are influenced by sexuality and race, who you know and how ‘PC’ you are. Today’s fastest growing job title is, ‘Chief Human Resources Officer’.

These measures impede innovation, entrepreneurship, and social mobility. Inevitably it’s the poor, trapped in learned victimhood and despair, who suffer most.

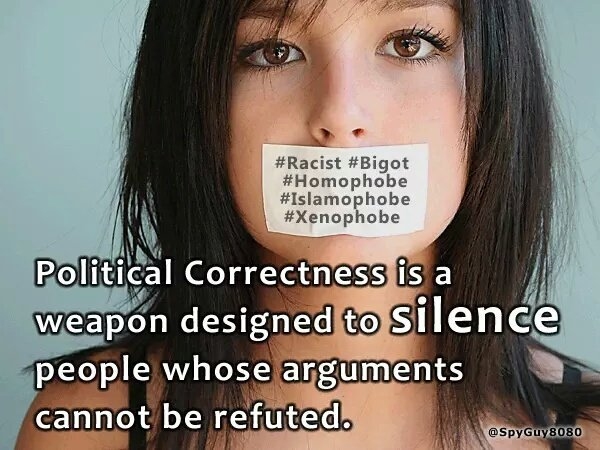

But who will publicly champion our freedoms and heritage? When even the word ‘mother’ can cause offence and, being politically incorrect is career limiting and socially ostracising, it’s understandable that intellectual cowardice is everywhere. And advocates certainly won’t be found within big government or big business and least of all, given their ideological predispositions, within our schools, universities, or the media.

So, while Karl Marx’s deception, ‘From each according to his ability, to each according to his needs’, has been exposed, the enemies of individual liberty, equality, and free market capitalism, continue to hold ideological sway. It’s a sorry tale. These authoritarian elites maintain power through a ‘divide and rule’ strategy, rendering ‘national interest’ a meaningless term. Their assault on the legitimacy of our values and institutions also attracts the attention of unfriendly foreign parties eager to exploit divisions and sensing opportunities should a small nation, rich in natural resources, suffer societal collapse.

Australian governments ignore these threats. They concentrate on racism and pronouns and subsidise the world’s fastest per capita renewable energy roll-out. It may keep climate change critics at bay, but it is a futile gesture with serious economic and social consequences.

Clearly, neo-tribalism and superstition have overtaken national security. As Ayn Rand foretold, we are free to stumble blindly down any road we please, but not free to avoid the abyss we refuse to see. That abyss is rapidly approaching.

https://spectator.com.au/2022/07/rainbows-and-rubber-bullets

****************************************My other blogs. Main ones below:

http://dissectleft.blogspot.com (DISSECTING LEFTISM)

http://edwatch.blogspot.com (EDUCATION WATCH)

http://antigreen.blogspot.com (GREENIE WATCH)

http://australian-politics.blogspot.com (AUSTRALIAN POLITICS)

http://snorphty.blogspot.com/ (TONGUE-TIED)

*****************************************

/>

/> Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

No comments:

Post a Comment