Friday, February 07, 2014

British charities accused of giving millions to left-wing campaigns as watchdog refuses to name causes under investigation

Charities are using millions of pounds of public money to subsidise fashionable political campaigns, a report warns today.

A study by the Institute for Economic Affairs says many well-known charities are using taxpayers’ cash to push for causes, such as increased foreign aid spending, which ‘are not priorities for the electorate and are often unpopular’.

It comes as MPs condemn the Charity Commission as feeble and 'not fit for purpose' as the watchdog refuses to name charities which are under investigation.

Warning that the practice undermines the democratic process, the IEA report calls on ministers to introduce strict curbs.

The report’s author, Christopher Snowden, said: ‘Using taxpayers’ money to fund special interest groups is both immoral and an inefficient use of public money.

'By crowding out privately-funded voluntary organisations, this taxpayer-funded bloc of charities, quangos and non-government organisations subverts the democratic process.

‘It is vital that measures are introduced to prevent state-funded political activism and make taxpayers aware of how their money is being spent. Charities and NGOs that are dependent on government funding are not independent of government.’

The study examines the activities of 25 charities that receive funding from the taxpayer. In many cases, taxpayer support makes up a large proportion of the organisation’s total funding.

The charities involved run political campaigns ranging from curbs on tobacco and alcohol to support for tackling climate change and opposition to welfare reforms.

The homeless charity Shelter, which receives £3.5million from the taxpayer, has run a vociferous campaign against the Government’s so-called bedroom tax. The funding is almost 10 per cent of its income.

And Save the Children, which has run a campaign against welfare reform, receives £54.3million.

The charity has also drawn criticism for paying bumper salaries to its executives. At the weekend it emerged that its top official is paid an astonishing £234,000 a year.

In a statement, the charity said: ‘Save the Children has a proud history of campaigning for the rights of children that has always been, and will remain forever, above party politics.’

The study warns that charities and quangos remain dominated by left-wingers. It highlights research showing that, of those appointees prepared to express a preference, 77 per cent declared support for Labour.

In a separate report the Charity Commission is condemned as ‘not fit for purpose’ by a parliamentary committee.

The names of 13 charities placed under statutory investigation by the watchdog have not been made public, meaning donors cannot know if their money is being properly spent.

In a devastating assessment MPs warn that the ‘feeble’ charities watchdog has failed to deal with clear-cut cases of abuse of charity regulations.

The Commons public accounts committee said it also had ‘little confidence’ in the watchdog’s ability to tackle its shortcomings.

The committee’s Labour chairman Margaret Hodge said: ‘We are dismayed by the fact that the Charity Commission is still performing poorly and failing to regulate the charity sector effectively. It is obvious that it has no coherent strategy and has been simply buffeted by external events.

‘It is clear that the Charity Commission is not fit for purpose.

‘The commission too willingly accepts what charities tell it when it is investigating alleged abuses. It too often fails to verify or challenge the claims made. Some of the most serious cases of abuse have not been properly investigated.

‘It has been too slow in removing or suspending trustees and in pursuing investigations promptly.’

Today’s report singles out for criticism the Charity Commission’s botched handling of the Cup Trust - a tax avoidance scheme that raised £173 million but gave only £55,000 to good causes.

William Shawcross, who succeeded the controversial Dame Suzi Leather as Charity Commission chairman in 2012, last night rejected the criticism. Mr Shawcross said the organisation was now heading ‘in the right direction’. He added: ‘I completely reject the suggestion that the Commission lacks a coherent strategy. ‘I am confident that we are taking the Commission in the right direction.’

But Sir Stuart Etherington, chief executive of the National Council for Voluntary Organisations, said that although there were some recent signs of improvement, the committee’s criticisms were justified.

SOURCE

On the Abortion Front, Good News for Babies

Does everyone agree that the recent news on abortion is actually quite promising? Abortions are in decline.

Abortion is at its lowest level since Roe v. Wade in 1973 legalized it. There were 1.05 million abortions in 2011, down 13 percent from the 1.21 million abortions committed in 2008. We are heading back in the direction of the 1.03 million abortions committed in 1975. All this information comes from the Guttmacher Institute's report "Abortion Incidence and Service Availability in the United States, 2011," and the Guttmacher Institute favors abortion along with the more humane forms of birth control. So when even the Guttmacher Institute agrees abortion is down, it has got to be down.

Not only is the number of abortions down, but also the incidence of abortion. The frequency of abortions has dropped to 16.9 abortions per 1000 women in 2011. That, too, is the lowest since 1973. The decline is widespread across the country, a national trend. In 2011, there were some 40,000 fewer abortions than in 2010. In recent years, abortion has been falling by 4 and 5 percent a year. Also the number of abortion facilities has declined. Between 2008 and 2011 the number declined by 4 percent. The number of women with unintended pregnancies choosing abortion dropped from 47 percent to 40 percent from 2000 to 2010.

The debate about abortions is having an effect, and the opponents of abortion are winning. This is a long-term debate, however, and it has been uphill all the way. When the Supreme Court intruded into the debate with its decision, it was up to the opponents of abortion to organize nationwide, and that is what they have done. The opposition to abortion has grown and so have the laws making an abortion harder to get. Brenda Zurita, a research fellow for the Concerned Women of America's Beverly LaHaye Institute, asserts that since 2010 the number of "pro-life laws" has multiplied: "In 2011, there were 92 pro-life laws passed; in 2012, there were 43 passed, and in 2013, there were 70 more." She adds that 81 clinics closed in 2013. The fact is, increasingly abortion is unlikely to be a spur of the minute decision.

In reading these statistics, I note that there is a heretofore invisible agent in the abortion debate. We all know about the women at the helm of the pro-abortion movement -- most of them call themselves feminists. But has anyone noted that it is women who are leading the anti-abortion movement, too? Sure there is ex-governor Sarah Palin, who led the fight with tireless advocacy and even by example, taking her baby with Down syndrome to term. She has braved the abuse of the pro-abortion militants and deserves the support of all Americans. Yet, has anyone noted the ordinary women leading the movement at the local level? Women are taking responsibility for their lives and the lives that they carry in their wombs. They are doing what Irving Kristol once remarked women in pre-feminist societies always did, to wit: They stood as society's last line of defense for morality.

When feminists transformed abortion into a "women's issue" they ignored the millions of women who always opposed abortion as preeminently a moral issue. They also ignored the millions of irresponsible men who were delighted to leave abortion as a women's issue. These men never wanted to be held accountable for the child they fathered in the first place. Yet women and men have recognized steadfastly that abortion is one of the foremost moral issues of our time. They have moved the conscience of America to consider the moral heft of abortion and slowly, steadily they are rolling back Roe v. Wade.

In answer to my initial question, everyone does not agree that the abortion news is good. But now the mindless acceptance of abortion has been challenged. The champions of abortion have to face up to the fact. There is a growing number of Americans who fear that abortion is killing babies and it ought to be stopped.

SOURCE

UK tax system is 'punishing success' says Institute for Fiscal Studies

Forcing Britain’s highest earners to foot a greater share of the nation’s tax bill is putting the Government’s long-term finances at risk, a leading economic think tank has warned.

The Institute for Fiscal Studies raised concerns about the state’s growing reliance on tax revenue from a small number of high earners.

“Lumping more taxes on the rich” is not a sustainable long-term strategy, the IFS suggested, as it warned that the ability and willingness of high earners to pay more tax could eventually run out. The think tank’s warning coincides with a heated debate in Westminster about the tax burden being placed on those with the largest incomes, with Conservative MPs warning against “soaking the rich” to fund services for the rest.

Official figures show that 300,000 people earning more than £150,000 a year now pay almost 30 per cent of all income tax — and 7.5 per cent of all tax revenue.

This places the stability of the public finances under threat because high earners whose taxes prop up the state could opt to emigrate, find ways of reducing their tax bills, or simply suffer declines in their fortunes, the IFS said. Government spending plans have become “very sensitive” to changes in the behaviour and status of a group that includes bankers and business executives and owners, as well as senior public employees including some NHS doctors.

If revenue from that small group falls, the Government would be forced to borrow even more money than it is now, the IFS said, suggesting that the Treasury should try to widen the tax base by targeting other sources.

“The Government might be concerned if the Exchequer becomes increasingly reliant on one particular revenue source, as it increases the risk that a shock to one revenue source would have serious implications for total revenues,” the IFS said in its annual Green Budget.

Politicians should resist the “knee-jerk” urge to tax the rich harder during downturns or risk them leaving the country, the economists said.

Rowena Crawford, a senior economist at the IFS, urged ministers to consider the stability of the tax base “rather than at the first sign of problems lumping more taxes on the rich people because of 'the broadest shoulders and all that’ ”.

“The world is more mobile than it used to be,” she said.

“You become sensitive to the payment behaviour of those individuals. If you push them too far and they emigrate then you lose revenue.” The IFS did not call for a tax cut for high earners, but its findings offered encouragement to Conservative MPs who believe that David Cameron should ease the burden on the rich.

Steve Baker, the Conservative MP for Wycombe, said: “It is a cruel fairy tale to believe that 99 per cent of the public can live on the earnings of one per cent.

“A policy of soak the rich is not a sensible one; the system cannot sustain itself.”

Supporters of lower tax for high earners argue that lower rates would encourage people to earn more in the UK, ultimately pushing up overall tax revenues. Last week the Labour Party pledged to lift the top rate of tax from 45p to 50p if it wins the next general election, and challenged Conservative ministers to rule out any cut in the top rate of tax.

Danny Alexander, the Liberal Democrat Chief Secretary to the Treasury, said on Wednesday that the top rate would be brought down to 40p — its level before the financial crisis — “over my dead body”.

However, Boris Johnson, the Mayor of London, indicated that plans to cut taxes for the richest would appear in the Conservative manifesto, which is being written by his brother, Jo, the Orpington MP and head of the No. 10 Policy Unit.

“I don’t think we are going to go into an election with a campaign to keep our tax rates higher,” the Mayor said.

The IFS criticised Coalition moves to shrink the tax base further by lifting the personal allowance to £10,000, at a cost of £10 billion a year.

The Liberal Democrats plan to raise it higher, to £12,500, costing a further £12 billion a year.

The policy is an poorly targeted and expensive way of making the poorest better off and the money would be better spent by increasing the personal allowance on National Insurance contributions, or by allowing people on benefits to keep more of their own money when they start work, the think tank said.

Labour’s plans to reintroduce a 10p tax rate would be even less well targeted at the poorest and would make the tax system more complicated, it claimed.

“It is hard to find a coherent economic rationale for it,” the IFS said.

The IFS identifies two trends that have forced a shrinking band of people to bear a growing share of the State’s tax revenue.

The tax burden has shifted from business taxes and fuel duties onto personal taxation and property taxes. The share of taxes borne by capital gains tax, stamp duties and inheritance tax is expected to reach 5 per cent by 2018, the highest since records began in 1978.

At the same time, the Government has become reliant on the top one per cent for a greater share of the tax take, rising from 21.3 per cent in 2000 to 29.8 per cent this year.

In the same period, that one per cent’s share of the national wealth before tax has risen more slowly, from 11 per cent to 13.7 per cent.

Their true contribution is even higher because the wealthiest pay a “large fraction” of VAT and capital taxes.

The stamp duty from the London boroughs of Westminster and Kensington and Chelsea alone account for 14 per cent of all revenue.

The shrinking tax base may discourage politicians from curbing inequality, as it is in the taxman’s interest that the super-rich prosper.

“It could be better for you if the top one per cent has roaring income growth and everybody else ticks along, because you get more revenue out of it,” Ms Crawford said.

The Prime Minister has declined to rule out cutting the top rate but insists any tax cuts will be targeted at low and middle-income voters.

SOURCE

Window and door rules axed in drive to get Britain building houses

David Cameron will today announce a drive to build thousands more homes by slashing building regulations.

More than a hundred rules applied to new homes will be pared back to fewer than ten in a bonfire of “crazy and over-zealous” red tape, the Prime Minister will say.

The move will save developers £60m a year, equivalent to £500 for every new property built. It is hoped the move will result in far more homes being constructed.

Rules setting out minimum window sizes, the dimensions of rooms, the strength of front doors, and arrangements for toilets, lighting, telephone lines and disabled access will be culled in the review.

The rules being targeted have been imposed by council planning officers or industry lobbyists on top of perfectly sound national basic standard.

However, it will lead to fears that greater numbers of poorly designed homes may be built in some areas. The average new home now has the same floorspace as a tube carriage, and home sizes have halved since the 1920s.

Mr Cameron will tell the Federation of Small Business that his will be the first Government in modern history to leave office with fewer regulations than when it entered, saving firms £850m a year.

He will promise to scrap “needless” health and safety regulations dictating how to use ladders and what non-smoking signs should look like.

The forthcoming Deregulation Bill will make one million self-employed people exempt from health and safety altogether.

A “ridiculous” rule that dictated that childminders who give food to infants need to register as a food business has also gone.

His Government has already amended the “crazy” Equality Act that means people cannot sue their employer if they are “insulted” by a customer, the Prime Minister will say, and shopkeepers no longer need a poison licence to sell oven cleaner.

“I have insisted on slashing needless regulation. We will be the first government in modern history to have reduced - rather than increased – domestic business regulation during our time in office,” the Prime Minister will say.

“This will make it easier for you to grow, to create jobs and to help give this country the long-term security we are working towards. More than 1.3m new jobs have been created since I came to office – many of them by small businesses. And I know many of you want to grow further – or may be thinking of employing your first person - but have been put off or held back by red tape.”

He will also announce 80,000 pages of so-called “green tape” environmental regulations will be ditched by March 2015, saving firms £100m a year.

SOURCE

*************************

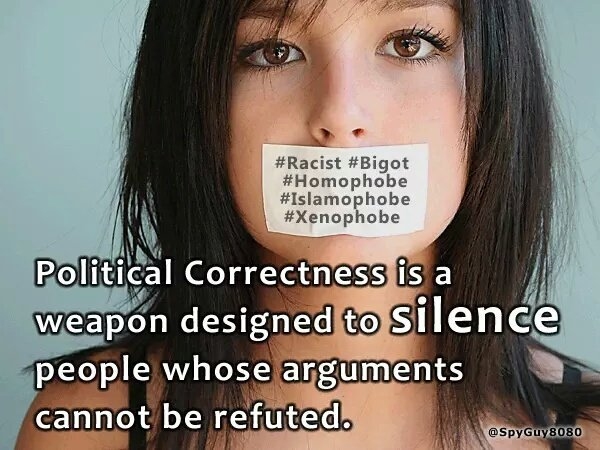

Political correctness is most pervasive in universities and colleges but I rarely report the incidents concerned here as I have a separate blog for educational matters.

American "liberals" often deny being Leftists and say that they are very different from the Communist rulers of other countries. The only real difference, however, is how much power they have. In America, their power is limited by democracy. To see what they WOULD be like with more power, look at where they ARE already very powerful: in America's educational system -- particularly in the universities and colleges. They show there the same respect for free-speech and political diversity that Stalin did: None. So look to the colleges to see what the whole country would be like if "liberals" had their way. It would be a dictatorship.

For more postings from me, see TONGUE-TIED, GREENIE WATCH, EDUCATION WATCH INTERNATIONAL, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS and DISSECTING LEFTISM. My Home Pages are here or here or here. Email me (John Ray) here.

***************************

Subscribe to:

Post Comments (Atom)

/>

/> Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

No comments:

Post a Comment