Wednesday, September 15, 2010

British banks' contempt for customers revealed as investigation finds thousands of complaints ignored

This corresponds with my experience of British banks more than a quarter of a century ago. Obviously nothing has changed.

Their arrogance is unparalleled. Combine an oligopoly with a deep British resentment of serving others and that is what you get.

That resentment is why most hotels and retailers in Britain are now in the hands of Indians. They provide service at a level which most Brits would regard as "beneath" them. The Brits would rather live on welfare and many do.

It was a grave mistake to bail out these arrogant institutions during the financial crisis. The Labor government should have allowed them to go broke and then sold them off to Indians for what little they were worth.

The British government should sell them off right now as a way of recovering the funds poured into them

Tens of thousands of legitimate complaints are being fobbed off and ignored by our High Street banks. Damning figures released yesterday by independent disputes arbitrator the Financial Ombudsman service lay bare the contempt shown by some of our biggest banks to customers who dare to complain.

The figures, which cover the six months to June 2010, show in some instances, more than nine in ten cases previously rejected by the banks are being decided in the customers’ favour.

They also come two years after taxpayers spent more than £65 billion propping up Royal Bank of Scotland/NatWest and Lloyds Banking Group.

‘Highlights’ of the FOs report include:

* A shocking 23 pc surge in complaints about insurance products, including payment protection insurance;

* A staggering 95 pc of Barclays insurance complaints upheld;

* State-backed Lloyds Banking Group received 22,420 complaints — more than a quarter of the total complaints received across more than 100,000 businesses;

* Five companies — including state-backed Lloyds TsB — received more than 3,000 complaints.

Consumer groups say the high proportion of complaints being upheld by the Ombudsman is further evidence the banks are failing to investigate grievances properly. Mark Gander from Consumer Action Group says: ‘This is proof of the disgusting way banks are dealing with disgruntled customers. ‘The whole complaints handling process is designed to exhaust customers so they give up. Incredibly, they are allowed to get away with it.’

For customers, the Ombudsman is the last resort. It can investigate complaints that have been rejected by the firm or that are not resolved within eight weeks.

Kay Blair, vice-chairman of the Financial services Consumer Panel, says: ‘It is appalling that so many High street banks continue to reject valid complaints so customers have to go to the Ombudsman for a fair assessment.

The number of overall complaints increased slightly (84,212, from 82,136) compared with the last six months of 2009. Overall, almost half (44 pc) were upheld in the customer’s favour.

There was a huge 23 pc increase in complaints about insurance policies. This was mainly driven by an increase in complaints from customers mis- sold payment protection insurance (PPI) alongside loans and credit cards. An estimated two million customers hold PPI policies they are unable to claim on.

The percentage of insurance complaints upheld against the big banks was high across the board, with more than nine in ten upheld against Barclays (95 pc) and Black Horse — part of the Lloyds Group (96 pc). More than eight in ten customers won their complaints against Lloyds TsB (86 pc) and Clydesdale Bank (89 pc).

Last year the Ombudsman accused banks of appearing to deliberately fob off complaints in the hope they go away, or using it as a cheap disputes-resolution service.

Mike O’Connor, chief executive of Consumer Focus, says the situation doesn’t seem to be improving. He says: ‘Consumers want companies to take complaints seriously and put problems right first time. These results suggest that too many companies are not taking complaints seriously and are content to leave customers to pursue problems with the Ombudsman instead.’

Overall, Lloyds- owned Black Horse was the worst culprit — nine in ten of all new complaints against the firm were upheld in the customer’s favour. It sells PPI alongside personal loans and car finance. James Daley from Which? Money says: ‘This adds insult to injury to the millions of taxpayers who have bailed out the banks.’

Barclays was one of the main offenders overall , with the Ombudsman upholding six in ten general complaints. Last year hundreds of readers who were persuaded by Barclays salesmen to invest their life savings in risky funds contacted Money Mail after their complaints were thrown out by the bank. Many of these complaints were later backed by the Ombudsman.

A British Bankers’ Association spokesman says: ‘The UK banking industry manages more than 140 million bank accounts, and the biggest conduct many billions of transactions each year, so it is important to keep these figures in context. The Ombudsman upholds only seven complaints per 100,000 products provided by banks.’

SOURCE

Good riddance to bad rubbish

An enemy of free speech to retire

The controversial judge who pioneered privacy law in Britain is to step down from his post in charge of media cases. Mr Justice Eady, 67, whose landmark rulings have protected the rich and famous from publicity about their sexual adventures, will quit his role at the end of the month.

He will be replaced by another senior judge who is regarded as less sympathetic to the wish of sports stars and celebrities to keep their infidelities private. The new judge in charge of libel and privacy cases is Mr Justice Tugendhat, who earlier this year allowed newspapers to report allegations about the sex life of England footballer John Terry. He said sports stars were interested in sponsorship contracts as well as privacy, and that it is important to protect the freedom to criticise behaviour on moral grounds.

During Sir David Eady's reign as judge in charge, an English privacy law has grown up in the courts. Developed from judges' interpretations of human rights rules, it has made it unlawful to speak or write the truth about matters covered by privacy decisions.

His most famous case involved a report in the News of the World about motor racing boss Max Mosley and his sado-masochistic orgy with five prostitutes. Mr Justice Eady ruled against the paper and fined it for breaching Mr Mosley's privacy.

Sir David can continue hearing cases until he reaches 70, the retirement age for High Court judges.

SOURCE

French Senate passes ban on burqas

THE French Senate has passed a bill prohibiting the burqa in public, and the ban will come into force next year if it is not overturned by senior judges.

The Senate passed the bill by 246 votes to one and, having already cleared the lower house in July, the bill will now be reviewed by the Constitutional Council, which has a month to confirm its legality. It will need President Nicolas Sarkozy's signature.

The text makes no mention of Islam, but President Nicolas Sarkozy's government promoted the law as a means to protect women from being forced to wear Muslim full-face veils such as the burqa or the niqab.

Once in force, the law provides for a six-month period of "education'' to explain to women already wearing a face veil that they face arrest and a fine if they continue to do so in any public space.

A woman who chooses to defy the ban will receive a fine of $200) or a course of citizenship lessons. A man who forces a woman to go veiled will be fined ($41,000) and serve a jail term.

"This law was the object of long and complex debates,'' the Senate president, Gerard Larcher, and National Assembly head Bernard Accoyer said in a joint statement explaining their move. They said in a joint statement that they want to be certain there is "no uncertainty'' about it conforming to the constitution.

The measure effects less than 2,000 women.

Many Muslims believe the legislation is one more blow to France's second religion, and risks raising the level of Islamophobia in a country where mosques, like synagogues, are sporadic targets of hate.

However, the vast majority behind the measure say it will preserve the nation's singular values, including its secular foundation and a notion of fraternity that is contrary to those who hide their faces.

France would be the first European country to pass such a law though others, notably neighbouring Belgium, are considering laws against face-covering veils, seen as anathema to the local culture.

"Our duty concerning such fundamental principles of our society is to speak with one voice,'' said Justice Minister Michele Alliot-Marie, opening a less than five-hour-long debate ahead of the vote.

The measure, carried by Sarkozy's conservative party, was passed overwhelmingly by the lower house of parliament, the National Assembly, on July 13.

SOURCE

Australian grandad falsely accused of rape and incest

Another gross "child safety" bungle. And the bureaucrats refused to admit their error until the light of publicity was shone upon it -- again as per usual

THE Queensland Department of Child Safety has refused for 18 months to correct a file that falsely accused a man from Toowoomba of being a rapist who was jailed for fathering his own grandchild. The 64-year-old man was told by the department to prove he was not a rapist.

When he presented a certificate from the police service saying he did not have a criminal record and a DNA blood test showing he was not the father of his granddaughter, the department still refused to believe him. The man was banned from having contact with his nine-year-old granddaughter, and she was not allowed to stay with him and his wife for holidays, which she had done for the preceding eight years.

The grandfather repeatedly wrote to Child Safety Minister Phil Reeves, his local state MP and former attorney-general Kerry Shine, and the Parliamentary Ombudsman - all to no avail. When The Australian contacted Mr Reeves's office on Monday, it took just three hours to confirm the error and for a departmental officer to be ordered to contact the accused grandfather and apologise for the "inaccuracy recorded in the file". The file contained details of a criminal with an identical surname and first initial, according to department officials.

The accusation of being an incest rapist was discovered by the grandfather last year when he sought access to his file under Right to Information legislation. One document, from August last year, alleged the girl "was a product of rape and the father/grandfather is now currently in prison".

The grandfather yesterday told The Australian he was "shattered" when he read the document and immediately questioned it with department officers but was told the file would not be altered.

He pointed out the obvious: he could not be the person in the document because he was sitting opposite them, not in prison.

"Finally the DCS complaints officer told me that I had to prove I was not a rapist and had not fathered my grandchild," he said yesterday, breaking down in tears. "So I asked the police to detail my criminal history - there was no history of crime - and my wife and I sold our caravan to get the $800 to pay for a DNA test which showed I was not the father of my granddaughter."

"Yet despite having this evidence before them, until your newspaper contacted minister Reeves, nobody would do anything, and we were warned about going to the media."

The nightmare began when the grandfather sought kinship carer status for his daughter's two children. She had difficulty looking after them because she was the victim of domestic violence from a drug-addicted husband who is in prison for stealing. The application by the grandparents was refused, with no reason given. Instead the two children were put in foster care for several months until their mother was again able to cope.

The mother of the children yesterday told The Australian it was "abhorrent" to accuse her hard-working father of rape. "What this department has done to my parents is indescribable," the mother said.

Yesterday Toowoomba police held the grandfather in the watchhouse for 30 minutes after saying they had received a complaint from his DCS case officer, Nicole Steele, alleging that he had threatened her in a telephone conversation with other staff. "I made no threats and I refused to give a statement, so they let me go," the grandfather said.

"The apology given to me by the department meant nothing. Why didn't it come a year ago - and what about all the money it has cost me in telephone calls and running around. The least they could do is refund the $800 it cost for the DNA test."

A statement released yesterday, said Department of Communities acting director-general Bette Kill "has apologised to the person in this case for an inaccuracy recorded in his file". "The department will undertake a review of the file and confidential information handling procedures to ensure an issue such as this does not happen again," the statement said.

SOURCE

Australian judge blocks 14-year-old Muslim girl's arranged marriage

A 14-YEAR-old girl has been banned from leaving Australia and has had to surrender her passport to save her from an arranged marriage. Just days before the girl's father planned to whisk her overseas to marry a man she has never met, the Family Court ordered she must stay.

The Melbourne teenager is one of a number of Australian girls forced into arranged marriages overseas each year. Her plight came to light when child protection officers received a report in June that the then-13-year-old had been taken out of school ahead of her intended marriage. In a landmark decision published on Monday, the Family Court barred the girl, who cannot be identified for legal reasons, from travelling abroad until she turns 18.

Federal Police were ordered to place the girl's name alongside the names of accused serious criminals and tax cheats on the official Watch List at departure points around the nation.

Her family, who are believed to be Muslims from the former Yugolsav Republic of Macedonia, has had to surrender the girl's passport and cannot apply for a new one.

According to court documents, the girl had been interviewed by two child protection workers at her home while her parents were at work. One of the officers said the girl told them she had been engaged for a month to a 17-year-old boy from another country but did not know what she felt about marrying him because she had never met him and had only ever seen a photograph of him.

The officer said he formed the opinion the girl had not considered the prospect of having sex with her new husband or the possibility of being abused. He said the girl indicated she had not discussed her feelings with her parents and did not know her mother's opinion of the marriage.

"It is my belief that it would not be in [the child's] best interests to travel . . . to be married as she is a child and she does not appear to understand the consequences of marriage," the officer's affidavit concluded. "Furthermore she would be deprived of a school education and she may be at risk of sexual exploitation and emotional harm."

Islamic Council of Victoria vice-president Sherene Hassan said arranged child marriages were a perverse practice not mandated by Islam. "According to Islamic law a woman must give her consent to marriage without any form of collusion," she said yesterday. "Sadly there are some Muslims that fail to discern [the difference] between culture and religion."

SOURCE

*************************

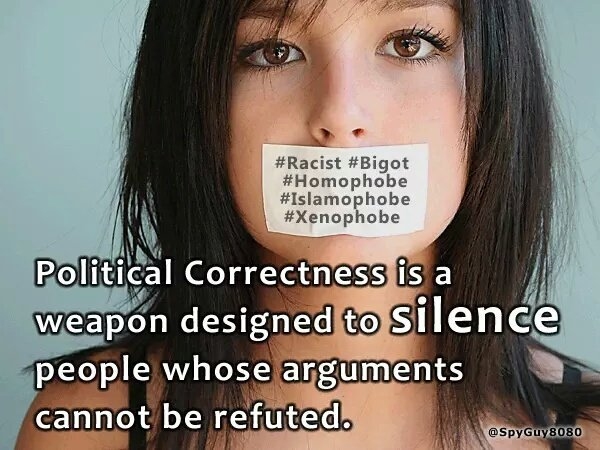

Political correctness is most pervasive in universities and colleges but I rarely report the incidents concerned here as I have a separate blog for educational matters.

American "liberals" often deny being Leftists and say that they are very different from the Communist rulers of other countries. The only real difference, however, is how much power they have. In America, their power is limited by democracy. To see what they WOULD be like with more power, look at where they ARE already very powerful: in America's educational system -- particularly in the universities and colleges. They show there the same respect for free-speech and political diversity that Stalin did: None. So look to the colleges to see what the whole country would be like if "liberals" had their way. It would be a dictatorship.

For more postings from me, see TONGUE-TIED, GREENIE WATCH, EDUCATION WATCH INTERNATIONAL, FOOD & HEALTH SKEPTIC, GUN WATCH, AUSTRALIAN POLITICS, DISSECTING LEFTISM, IMMIGRATION WATCH INTERNATIONAL and EYE ON BRITAIN (Note that EYE ON BRITAIN has regular posts on the reality of socialized medicine). My Home Pages are here or here or here or Email me (John Ray) here. For readers in China or for times when blogger.com is playing up, there is a mirror of this site here.

***************************

Subscribe to:

Post Comments (Atom)

/>

/> Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

No comments:

Post a Comment