Wednesday, October 19, 2016

How the housing boom is remaking Australia’s social class structure

This is quite a sober article but it does fall into the mould of a Leftist scare story: "We'll all be rooned, said Hanrahan". It's fault lies in its confidence that accurate prophecies are possible. In particular, it relies on straight-line extrapolation: The really dumb belief that all trends will continue unchanged. It does not allow for Taleb's "Black Swan" events. And just such an event is now happening. So it is sad that the erudite academic below has not allowed for it. He has seen it but has not understood it.

I refer to the huge inflow of Chinese money that is behind the orgasm of apartment building which has now been going on in the big cities for a year or more. Huge apartment buildings are springing up like mushrooms all over the place. There must be a dozen within 5 minutes' drive of where I live in Brisbane. The process has already brought new accommodation to glut proportions in Melbourne.

And the law of supply and demand tells us what must happen. A prediction based on the law of supply and demand is as certain as a prediction based on straight-line extrapolation is not. As the supply of apartments races ahead of the normal demand, the prices will fall and the demand will expand to take up the supply. We are in other words looking at a major fall in the price of housing in roughly a year's time. The apartment glut will even hit house prices as the demand for accommodation is somewhat fungible. Some people who might have been in the market for a house will be diverted by the good value of a cheap apartment.

So the predictions below were out of date the moment they were written

The relentless housing boom in Australia’s cities, especially Melbourne and Sydney, is often framed as an intergenerational conflict in which younger generations are being priced out of the market by baby boomers. However, sociological theories of social class suggest parents’ wealth and social status will eventually be passed onto their children anyway.

So, by focusing on intergenerational inequalities that will eventually be reversed, we are framing the housing affordability question the wrong way. At the same time, the impact of the housing boom is so deep that some long-established ideas about social class may be no longer relevant.

The housing boom has blurred existing boundaries between upper, middle and lower classes that applied to the baby boomers and previous generations. New social class boundaries and formations are being produced.

This does not mean younger generations, as a collective, are disadvantaged compared to their parents. Rather, these younger generations will be subdivided differently and more unequally.

The renting class

In the industrial city, the term “working class” was defined by the experiences of low-income workers in manufacturing jobs. Yet in a post-industrial Australian city it makes more sense to talk about the “renting class”.

Not all renters are poor, and not all poor households are private renters. However, the correlation between the two is significant and strengthening. The proportion of private renters in the total population is slowly but surely increasing – from 20.3% in 1981 to 23.4% in 2011.

Simultaneously, public housing – once a symbol of the working class – is undergoing a dramatic demise.

Largely abandoned by the state to fend for itself, with weak regulation for security of tenure or rent control, the renting class faces the unrelenting burden of ever-rising rents. The average renter paid 19% of their income on rent in 1981. In 2011, this proportion increased to 26.9%.

And, in 2014, around 40% of low-income private renters were in housing affordability stress, paying more than one-third of their income on housing.

With hardly enough “after-housing” disposable income to meet basic living standards, savings for retirement is almost impossible for the low-income renter. And with little or no wealth to assist their children to buy a home, the renter’s social class status is likely to be passed from one generation to the next.

The home-owner class

More than just a status symbol, home ownership has become increasingly central to the way most Australians accumulate wealth. About half of the home-owner’s wealth is held in their own home. Each housing boom enriches them further through tax-free capital gain on their homes.

The housing boom also creates work in the construction industry, which is the third-largest employer in Australia with more than one million workers. These are no longer working-class occupations, with most skilled jobs paying average weekly earnings of close to A$1,500. So, it is arguably the home-owner class that benefits most from each construction boom.

One consequence of the housing boom is that a growing cohort of moderate-income households is now priced out of home ownership. Had they been born a generation earlier, they would have probably been able to afford a house. Now it is beyond their reach.

Over the years, as their rents rise and their wealth stagnates, the gap between the renter and a home owner will become unbridgeable. Their experience of retirement will be worlds apart.

One lifeline for this cohort is the prospect of inheriting some of the housing wealth of their baby boomer parents. But when this will happen is highly uncertain.

The housing elite

The housing elite is rewarded by the housing boom well beyond the capital gain on their own homes. Much of the massive wealth of Australia’s elite is generated through the housing market – through investment, construction and financing of housing.

Harry Triguboff, Australia’s third-richest person, earned his fortune in the apartment development business. So did the three youngest entrants into the 2016 BRW Rich List. Their entry marks the rising importance of housing in the making of Australia’s super-rich.

The top 20% of the wealthiest Australians hold most of their wealth in their home and in other investment properties. They also hold significant wealth in the sharemarket, which is commanded by big banks whose portfolios are heavily dominated by housing loans. Each housing boom significantly adds to their wealth.

Social class, however, is more than just financial wealth. The wealthiest Australians secure their social class position by living in exclusive suburbs where they are able to associate with the right people and live an elite lifestyle. The astronomical prices of houses in some of these suburbs ensure their hermetically exclusive nature.

Breaking the loop

None of these social class categories is natural or universal. These categories will not apply in some European countries, for example, that have very different housing systems.

The deepening fusion between Australia’s housing system and its social class system creates a dangerous cycle. The further house prices grow, the more important housing becomes as a determinant of social class. And when social class is increasingly defined by housing, people are willing to bid even higher to enter home ownership or the housing elite.

Unless we break this cycle, Australia will continue in its path of becoming a more polarised society, with a weakened renting class, an impenetrable elite, and a shrunken home-owner class between them.

SOURCE

Euro 'house of cards' to collapse, warns ECB prophet

The European Central Bank is becoming dangerously over-extended and the whole euro project is unworkable in its current form, the founding architect of the monetary union has warned.

"One day, the house of cards will collapse,” said Professor Otmar Issing, the ECB's first chief economist and a towering figure in the construction of the single currency.

Prof Issing said the euro has been betrayed by politics, lamenting that the experiment went wrong from the beginning and has since has degenerated into a fiscal free-for-all that once again masks the festering pathologies.

“Realistically, it will be a case of muddling through, struggling from one crisis to the next. It is difficult to forecast how long this will continue for, but it cannot go on endlessly," he told the journal Central Banking in a remarkable deconstruction of the project.

The comments are a reminder that the eurozone has not overcome its structural incoherence. A beguiling combination of cheap oil, a cheap euro, quantitative easing, and less fiscal austerity have disguised this, but the short-term effects are already fading.

The regime is almost certain to be tested again in the next global downturn, this time starting with higher levels of debt and unemployment, and greater political fatigue.

Prof Issing the lambasted the European Commission as a creature of political forces that has given up trying to enforce the rules in any meaningful way. "The moral hazard is overwhelming," he said.

European Central Bank is on a "slippery slope" and has in his view fatally compromised the system by bailing out bankrupt states in palpable violation of the Treaties.

"The Stability and Growth Pact has more or less failed. Market discipline is done away with by ECB interventions. So there is no fiscal control mechanism from markets or politics. This has all the elements to bring disaster for monetary union.

"The no bail-out clause is violated every day," he said, dismissing the European Court's approval for bail-out measures as simple-minded and ideological.

Otmar Issing was a towering figure at the Euro's inception © Bloomberg Otmar Issing was a towering figure at the Euro's inception The ECB has "crossed the Rubicon" and is now in an untenable position, trying to reconcile conflicting roles as banking regulator, Troika enforcer in rescue missions, and agent of monetary policy. Its own financial integrity is increasingly in jeopardy.

The central bank already holds over €1 trillion of bonds bought at "artificially low" or negative yields, implying huge paper losses once interest rates rise again. "An exit from QE policy is more and more difficult, as the consequences potentially could be disastrous," he said.

"The decline in the quality of eligible collateral is a grave problem. The ECB is now buying corporate bonds that are close to junk, and the haircuts can barely deal with a one-notch credit downgrade. The reputational risk of such actions by a central bank would have been unthinkable in the past," he said.

Cloaking it all is obfuscation, political mendacity, and endemic denial. Leaders of the heavily-indebted states have misled their voters with soothing bromides, falsely suggesting that some form of fiscal union or debt mutualisation is just around the corner.

Yet there is no chance of political union or the creation of an EU treasury in the forseeable future, which would in any case require a sweeping change to the German constitution - an impossible proposition in the current political climate. The European project must therefore function as a union of sovereign states, or fail.

Prof Issing slammed the first Greek rescue in 2010 as little more than a bail-out for German and French banks, insisting that it would have been far better to eject Greece from the euro as a salutary lesson for all. The Greeks should have been offered generous support, but only after it had restored exchange rate viability by returning to the drachma.

His critique will exasperate those at the ECB and the International Monetary Fund who inherited the crisis, and had to deal with a fast-moving and terrifying situation.

The fear was a chain-reaction reaching Spain and Italy, detonating an uncontrollable financial collapse. This nearly happened on two occasions, and remained a risk until Berlin switched tack and agreed to let the ECB shore up the Spanish and Italian debt markets in 2012.

Many would say the crisis mushroomed precisely because the ECB was unable to act as a lender-of-last resort. Prof Issing and others from the Bundesbank were chiefly responsible for this design flaw.

Jacques Delors, the euro's 'political' founding father, issued his own candid post-mortem last month on the failings of EMU but disagrees starkly with Prof Issing about nature of the problem.

His foundation calls for a supranational economic government with debt pooling and an EU treasury, as well as expansionary policies to break out of the "vicious circle" and prevent a second Lost Decade.

"It is essential and urgent: at some point in the future, Europe will be hit by a new economic crisis. We do not know whether this will be in six weeks, six months or six years. But in its current set-up the euro is unlikely to survive that coming crisis," said the Delors report.

Prof Issing is not a German nationalist. He is open to the idea of a genuine United States of Europe built on proper foundations, but has warned repeatedly against trying to force the pace of integration, or to achieve federalism " by the back door ".

He decries the latest EU plan for a 'fiscal entity' in the Five Presidents' Report, fearing that such move would lead to a rogue plenipotentiary with unbridled powers over sensitive issues of national life, beyond democratic accountability.

Such a system would erode the budgetary sovereignty of the member states and violate the principle of no taxation without representation, forgetting the lessons of the English Civil War and the American Revolution.

Prof Issing said the venture began to go off the rails immediately, though the structural damage was disguised by the financial boom. "There was no speed-up of convergence after 1999 – rather, the opposite. From day one, quite a number of countries started working in the wrong direction."

A string of states let rip with wage rises, brushing aside warnings that this would prove fatal in an irrevocable currency union. "During the first eight years, unit labour costs in Portugal rose by 30pc versus Germany. In the past, the escudo would have devalued by 30pc, and things more or less would be back to where they were."

"Quite a few countries – including Ireland, Italy and Greece – behaved as though they could still devalue their currencies," he said.

The elemental problem is that once a high-debt state has lost 30pc in competitiveness within a fixed exchange system, it is almost impossible to claw back the ground in the sort of deflationary world we face today.

It has become a trap. The whole eurozone structure has acquired a contractionary bias. The deflation is now self-fulling. Prof Issing's purist German ideology has no compelling answer to this.

SOURCE

Congress unleashes the Furies, but never at itself

by Jeff Jacoby

WHEN WELLS FARGO'S longtime CEO, John Stumpf, appeared before the Senate Banking Committee recently, Senator Elizabeth Warren tore into him with the relish of a Rottweiler mauling a favorite chew toy.

"You should resign," a wrathful Warren told Stumpf, who was summoned to testify after Wells Fargo acknowledged that thousands of its low-level employees had opened sham deposit or credit-card accounts for customers who never authorized them. "You should be criminally investigated." For the senior senator from Massachusetts, few pleasures compare with making the leader of a great financial institution squirm, and she milked the session for all it was worth.

"Have you returned one nickel of the millions of dollars that you were paid while this scam was going on?" demanded Warren three times as the cameras rolled. "You squeezed your employees to the breaking point so they would cheat customers and you could drive up the value of your stock and put hundreds of millions of dollars in your own pocket." She charged Stumpf with "gutless" leadership, and accused banks like his of routinely "cheating as many customers, investors, and employees as they possibly can." Wall Street will never change, Warren said ominously, until "executives face jail time when they preside over massive frauds."

In truth, Wells Fargo mostly cheated itself. The bank's aggressive "cross-selling" strategy, which tempted employees to sign customers up for accounts they never asked for, has cost the company far more than it gained. The fraudulent accounts generated only about $2.6 million in fees, which the company has refunded. That amount is dwarfed by the $185 million penalty imposed by federal regulators. Even more costly is the hit to Wells Fargo's reputation, and the loss of some of its biggest customers — including the state of Illinois, which this week suspended its annual $30 billion investment relationship with the bank.

Meanwhile, Stumpf himself has agreed to forfeit $41 million in stock awards and serve without pay for as long as the investigation lasts. Carrie Tolstedt, head of the Wells Fargo division where the misconduct was concenterated, will forfeit $19 million. Neither will be eligible for a bonus in 2016. And who knows? If Warren and other grandstanding members of Congress get their way, there may be worse humiliations to come.

If only members of Congress were held to the same standard.

Let's agree that Wells Fargo executives deserve to be flogged around the fleet because their ill-crafted policies resulted in perverse incentives that caused harm to hundreds of thousands of Americans. Shouldn't lawmakers expect comparable treatment when they blunder? If bank CEOs must submit to public excoriation and demands for salary "clawbacks" when their bad decisions injure the public, surely senators and representatives ought to face no less.

The hounds bay for Stumpf, Tolstedt, and other Wells Fargo officials to pay through the nose for abuses caused by their high-pressure sales culture. Yet where is the penalty for those who enacted — just for example — the disastrous Affordable Care Act? That fiasco, which has caused at least 7 million Americans to lose their employer-based health insurance, was premised on a gargantuan deception that has done vastly more damage than the Wells Fargo debacle. Even Bill Clinton describes Obamacare as a "crazy system" under which some of the most exhausted workers in the country "wind up with their premiums double and their coverage cut in half."

When will clawbacks be in order for that ruinous decision?

Or, to take another example, when will restitution be exacted from those responsible for the subprime mortgage crisis and the financial devastation it triggered? As former New York Mayor Michael Bloomberg noted in 2011, one of the key culprits in the meltdown "was, plain and simple, Congress." Obsessed with boosting homeownership rates, Congress passed laws that forced lenders to soften underwriting standards and make it easier for homebuyers with weak credit to get mortgages. When the inevitable day of reckoning came, millions of ordinary Americans suffered. But no Capitol Hill eminence resigned in disgrace or gave up a paycheck.

Time and again, members of Congress make foolish decisions that have terrible impacts. Fuel-economy standards imposed by Washington lead manufactures to make cars smaller and lighter — and therefore deadlier. Collective bargaining in the public sector forces ordinary taxpayers to bear the cost of government employees' exorbitant perks and pensions. Agricultural subsidies drive up the price of food. Federal minimum-wage hikes make it harder for low-skilled workers to get jobs. The ban on incentives for organ donors condemns hundreds of patients to die needlessly every year.

If corporate leaders like John Stumpf deserve to be raked over the coals when their business actions lead to wretched outcomes, there is no reason why government leaders like Elizabeth Warren shouldn't be subjected to equally withering denunciations when their legislative actions cause widespread harm. But it never seems to work that way, does it? Members of Congress don't hesitate to unleash the Furies on anyone whose misjudgments it is politically advantageous to attack. Of their own misjudgments they are infinitely tolerant — and voters, they know, have short memories.

SOURCE

Australia: Some VERY "incorrect" advice for the unemployed

Tensions flared on Monday night's Q&A when industrial relations expert Grace Collier said the unemployed could solve their problems by starting their own businesses.

On a night when industrial relations was a key focus of the program, Ms Collier's remarks sparked several on the panel into life and surprised many in the Melbourne studio audience.

The panel was discussing the future of manufacturing — namely whether governments should subsidise certain industries to keep them afloat and save jobs.

But Ms Collier, a News Corp columnist, said governments did not owe workers any favours.

"Nobody has an entitlement to a job. Society doesn't owe you a job. The Government can't get you a job. The Government shouldn't have to get you a job. There's no such thing as Government money. There's your money and my money," she said.

"Everybody has something that they're good at … You work out what you're good at and you try and make a career out of that."

When Greens Leader Richard Di Natale pointed out there were less jobs than people in Australia, Ms Collier fired back.

"People can start their own businesses," she said, leading to several people in the audience to start heckling.

"It's terrible, isn't it? Wouldn't it be awful to have to start your own business because someone else has to give you a job?" Ms Collier said.

"Why don't you start a business and hire some people? Go on. I dare you." "I'm busy at the moment," Mr Di Natale replied.

Australian Council of Trade Unions president Ged Kearney interjected, saying "nobody has any money in their pockets to spend in that business".

"We are losing our manufacturing industry and there's been absolutely no plan from this Government to try to reinvigorate manufacturing, to find where we can have a competitive edge in the global economy," she said.

Labor MP Tim Watts said the Coalition Federal Government had "nothing" for manufacturing industry workers.

However John Roskham, the executive director of right-wing think tank Institute of Public Affairs, said it was "desperately unfair" for the Government to have to subsidise each job in the car industry to the tune of tens of thousands of dollars.

Economist Judith Sloan disagreed with the whole panel, saying the Australian labour market had been strong for some time.

Has Trump killed the conservative movement?

Meanwhile, Donald Trump's lewd comments led the panel to consider what Australians would need to do to prevent a similar character taking the nation's top job.

Mr Watts labelled the Republican candidate's emergence as the death knell of the conservative movement.

"He's been able to enter the scene in the US because conservative ideology has imploded," Mr Watts said.

"There was a time when conservatives believed in things. What's happened in the US is they've invited people who have subverted these conventions, trashed these institutions into the mainstream."

Mr Di Natale said people were "fed up with establishment politics", leading them to turn to extreme candidates.

"What you're seeing, in my view, is people like Trump and One Nation and others who are scapegoating individuals, who are looking to foreigners and easy targets to blame for what are very complex social problems," he said.

But Mr Roskham said Mr Trump did not represent true conservatism because of his stance on importation tariffs.

"Trump would not have been my candidate or the candidate of a lot of conservatives of a lot of liberals and libertarians … If I was in America I would not know how to vote," he said. Ms Collier was more optimistic about the future, saying she didn't care who the US elected, provided Australia wasn't negatively impacted.

"Don't lose sleep over the stupid things Trump said, because there's going to be another one tomorrow. Don't worry about it," she said.

SOURCE

*************************

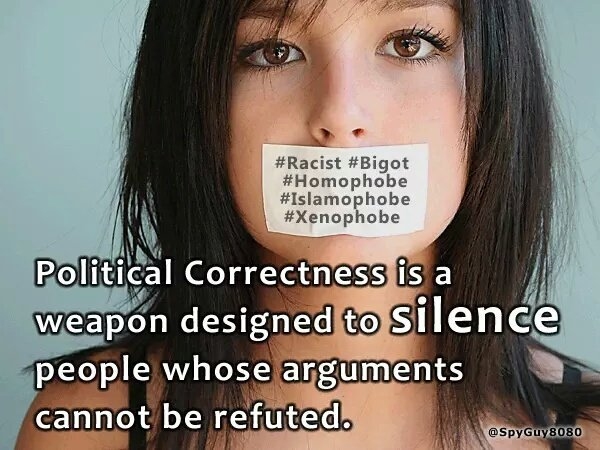

Political correctness is most pervasive in universities and colleges but I rarely report the incidents concerned here as I have a separate blog for educational matters.

American "liberals" often deny being Leftists and say that they are very different from the Communist rulers of other countries. The only real difference, however, is how much power they have. In America, their power is limited by democracy. To see what they WOULD be like with more power, look at where they ARE already very powerful: in America's educational system -- particularly in the universities and colleges. They show there the same respect for free-speech and political diversity that Stalin did: None. So look to the colleges to see what the whole country would be like if "liberals" had their way. It would be a dictatorship.

For more postings from me, see TONGUE-TIED, GREENIE WATCH, EDUCATION WATCH INTERNATIONAL, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS and DISSECTING LEFTISM. My Home Pages are here or here or here. Email me (John Ray) here.

***************************

Subscribe to:

Post Comments (Atom)

/>

/> Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

No comments:

Post a Comment