Friday, December 12, 2014

UK: Government U-turn on school cadet force funding

MoD says cadet forces will keep their funding after warnings reforms would seen dozens of units close

The Government has abandoned plans to reform school cadet force funding after outcry from private schools that increased costs would shut long-standing units.

Headmasters earlier this year warned dozens of private school cadet forces could close because of a “disastrous” cut in funding aimed at boosting representation in the state system.

The funding shake-up had been proposed as part of plans to introduce 100 new cadet units in state schools by the end of 2015. Ministers said existing Combined Cadet Force (CCF) units would have to share their funding with the new state school units to meet the target. Pupils would be forced to pay £150 a year to join and units would have to contribute more to their running costs.

The cut in funding would mean individual schools having to find tens of thousands of pounds for costs including equipment and adult volunteers, it was claimed.

Michael Fallon, the Defence Secretary, has now decided to keep the current funding and keep paying for adult volunteers, he said.

He said: “Cadet Forces offer young people the chance to develop essential skills and CCF units play an important role in providing this experience in schools

“I’m pleased to announce that all school cadet units will receive the funding they need to make this opportunity available across the country.”

At present, 260 schools run cadet forces and receive more than £26 million a year to cover staff training, uniforms, rifles, facilities and volunteer expenses.

Around 200 units are in private schools. The units are seen by many in the military as vital links between the armed forces and young people, as well as allowing them to broaden their skills and outlook.

Paul Luker, Chief Executive of the Council of Reserve Forces’ and Cadets’ Association, said the expansion plans were “greatly welcomed”.

He said: “It was therefore important for the Ministry of Defence to consult on the possible changes to CCF funding, and it is enormously reassuring that they have listened fully to the feedback received.”

The Ministry of Defence said plans were still on track to open 100 new cadet units in state schools by September 2015. They will be given an extra £2.3m of additional funding found from “efficiencies within the existing MOD cadet budget”.

A spokesman said: "All cadet units will have their infrastructure and running costs funded by the Government. Following a consultation into future funding of the Combined Cadet Forces, the Defence Secretary has decided to maintain the existing funding model and also to apply it to schools setting up new units under the cadet expansion programme."

Headmasters had been "very clear" about what they thought of the proposed changes, one Whitehall source said.

Thomas Garnier, head of the independent Pangbourne College, Reading, who represents the CCF for the Headmasters’ and Headmistresses’ Conference, said he was "delighted" with the about face.

He said many schools already made large sacrifices and commitments to keep their CCF units running.

He said: "We are really, really pleased that we were listened to and it reflects well on the MoD. I think there was a lack of understanding about the commitments that the schools with CCF units were making. I think they now have a clearer understanding."

Simon Davies, the head of Eastbourne College, which runs a 335-strong unit formed in 1895, said schools had been angered by a lack of Government consultation.

He said: "The key thing is that they need actually to ask people and to listen and not merely to tell people."

SOURCE

Using Allegations of Rape in a Grab for Power

Nine males were accused of being part of a heinous rape. The alleged injustice fomented a mob mentality. An enraged community wanted to skip any talk of a serious investigation, never mind a trial, and go straight to the punishment.

I’m not talking about the now-discredited allegations against fraternity members at the University of Virginia, but of the legendary case of the Scottsboro Boys, nine African-American teenagers falsely accused of rape in Alabama in 1931. Despite testimony from one of the women that she had made up the whole thing, the Scottsboro Boys were convicted in trial after trial. All served time either in jail or prison.

Scottsboro is a landmark case in the history of the civil rights movement and the American justice system. Sadly, it was hardly an outlier. There’s a long, tragic history of African-American men being wrongly accused and convicted of rape. The most notorious recent example is the 1989 case of the Central Park Five in which four African-American teens and one Latino were wrongly accused and convicted of brutally raping a white woman in New York.

Clearly, the injustices involved in these cases are far greater than what transpired at UVA. No one at the Phi Kappa Psi fraternity faced the death penalty or went to jail. But the lessons learned and principles involved are timeless and universal; everyone deserves the presumption of innocence.

Apparently, Zerlina Maxwell disagrees. She writes in the Washington Post: “We should believe, as a matter of default, what an accuser says. Ultimately, the costs of wrongly disbelieving a survivor far outweigh the costs of calling someone a rapist.”

Let’s cut to the chase. Maybe I live in a cocoon of some kind, but it seems to me that as terrible and unjust as it surely can be, the stigma of having been raped is hardly as deleterious to one’s reputation as the stigma of being accused of being a rapist. I don’t think I know anyone who would discriminate against a rape victim. I’d like to think I don’t know anyone who wouldn’t discriminate against a rapist.

Back to Zerlina Maxwell. She is a lawyer openly advocating the defenestration of the bedrock of American law: the presumption of innocence. More amazing and sad, she’s not alone.

In the wake of revelations that Rolling Stone reported as fact an unsubstantiated story of institutionalized gang rape, many feminist activists have dug in, saying, in effect, the truth shouldn’t matter, or at least it shouldn’t matter very much – not when there’s a “rape epidemic” engulfing college campuses. I put the term in quotation marks because I believe this alleged epidemic is largely a deliberate political fabrication.

Obviously, rapes happen. But this “epidemic” would have to coincide with a decades-long decline in forcible rapes and a decades-long increase in public intolerance for sexual assault and harassment. Moreover, the primary evidence activists cite is a bogus statistic, based upon a Web survey of two universities.

So what’s going on here? Beyond the hysteria and legitimate concern, this is a power grab. It’s no coincidence that the Rolling Stone article spent a great deal of time advocating for the expansion of federal involvement in higher education via Title IX of the Civil Rights Act.

As chronicled by Jessica Gavora (my wife) in her book “Tilting the Playing Field,” feminist activists, with the aid of sympathetic journalists and allies in the judiciary and the federal bureaucracy, have used Title IX as a “far-reaching remedial tool,” in the words of the New York Times, to reorganize higher education to their ideological agenda.

They started with women’s sports, but the model remains the same: Interest groups foment outrage, then enlist sympathetic activist journalists who rely on the testimony of deeply invested “experts” while partisan politicians exploit the allegedly systemic problem to advance an ideological agenda and demonize opponents as sexist bigots or rape apologists.

The UVA story was the perfect – too perfect it turns out – outrage at the exact moment the Obama administration was pushing new Title IX regulations that would erode the presumption of innocence in rape cases on campus. There’s no reason to expect this fiasco will even slow that effort. So cheer up, Ms. Maxwell. You’re winning.

SOURCE

No, the rich don’t pay a ‘fair share’ of tax. They pay all of it

The Australian case. You have to include what people get back from the government:

THE degree of ignorance about the distribution of tax across households is remarkable, especially given that the truth is so easily and freely accessible. For politicians perhaps it is wilful; the facts suit neither side.

The Left typically tries to create the impression the “rich” aren’t paying their “fair share”. Consider former treasurer Wayne Swan’s attacks on “mining billionaires” and welfare groups’ continual prattling about the financial benefit of concessional super taxation to high-income earners.

The Right, meanwhile, evokes the ordinary, “battling” taxpayer, whose hard-won earnings, so the argument goes, are siphoned off to pay for inefficient or ineffective government programs.

But the overwhelming bulk of people in Australia pay no net tax at all. High-income earners have become a giant pinata that the majority hit for extra money to pay for whatever new social spending programs the political class proposes to stay in office.

Our constitutional democracy, rather than safeguarding a set of inviolable tax rules applied under the rule of law, has become an elaborate mechanism for extracting resources from a small minority for the much larger majority. A crude summary might be “pay up or else”.

Only the top fifth of households ranked by their income - those with incomes of more than $200,000 a year in the financial year ending June 2012 - pay anything into the system net of the value of social security in cash and kind received, according to data from the latest Australian Bureau of Statistics survey of household income.

The distribution of personal income tax - the federal government’s biggest source of revenue, raising about 45 per cent of the total ($165 billion this year) - is far more progressive than headline marginal tax rates suggest. Including the 1.5 per cent Medicare levy, Australia’s income tax rates range from 19 per cent for every dollar of income above $18,200 to 46.5 per cent for every dollar above $180,000. Most taxpayers face a 34.5 per cent marginal rate.

But average income tax rates on households’ privately generated income (ordinarily wages and salaries, but dividends and rental income too) ranged from 1.5 per cent for the bottom fifth of households in 2012 to 22 per cent for the top fifth.

The 1.73 million households in the middle quintile paid an average tax rate of 12.3 per cent on average incomes of $88,900. But the ABS survey estimates these households received $31 a week in Age Pension payments, $13 in disability payments, $48 in child-related payments and $12 in unemployment benefits, along with a host of others that whittle their average net tax payments down to $84 a week.

This sort of analysis excludes the value of government benefits beyond cash: “free” schools, hospitals, public transport and the like, which the ABS estimated to be $413 a week for these middle-ranked households. Netting everything off shows even “average”, let alone lower-income, households got back $2.70 for every $1 they paid in tax. Households in the bottom quintile enjoyed benefits worth more than 320 times what they paid in tax compared with about 10 times for those in the second-lowest quintile.

Notwithstanding the enormous variation in the circumstances of individuals and households within each of these five buckets - for instance, childless, healthy workers will pay in much more than unemployed families with sick children - the disparities are as remarkable as they are little-known.

Factoring in payment of “regressive” taxes such as the GST and tobacco and alcohol excise doesn’t appear to alter the overall picture. Every six or so years the ABS painstakingly distributes the burden of these “taxes on production” across households, based on estimated consumption patterns.

In the financial year ending June 2010, what one might call “holistic average tax rates” (including indirect and direct taxes and net of social security in cash and kind) ranged from -64 per cent for the bottom quintile, to -22 per cent for median households and 13 per cent for the top fifth of households.

Put simply, only the top fifth of households paid any tax. The bottom 6.9 million households, while often incurring income tax liabilities and regularly paying GST, received more in cash welfare and services than they paid in.

The concentration of the tax burden on higher-income earners would be starker still if the many tens of thousands of senior local, state and federal public servants - whose salaries often exceed $200,000 a year - were considered a cost. One could argue that the taxes paid by workers whose jobs depend on taxing other workers are akin to a cash refund to everyone else, rather than an organic contribution.

It is absurd to claim the “rich” - assuming incomes rather than wealth are the defining criterion - aren’t paying their “fair share” of tax when they in fact pay all of it. Equally, to argue that the “average” worker is subsidising government folly is difficult given that their aggregate benefits exceed the tax they pay.

Without making any judgment about the merits or fairness of the status quo, the burden appears to be shifting further toward higher-income earners. Comparing the 2003-04 and 2009-10 financial years, holistic average tax rates fell on average 8.2 percentage points for the bottom three income quintiles, but only 4.6 per cent for the top two quintiles.

It is still difficult to explain why these rates fell because there are so many moving parts to the social security and income tax systems. Of course, lower tax rates do not imply that less tax is collected: the level and growth rates of income across income quintiles varies and a one-percentage-point drop in average tax rates for higher-income earners has far greater consequences for revenue than much bigger changes for others.

Separate data from the Australian Taxation Office confirm rising progressivity. Based on income tax returns from the 2010-11 financial year, the top 1 per cent of individual income earners - who in the 2010-11 tax year were those with taxable incomes of more than $281,800 a year - paid $23.55bn or 17.7 per cent of the total income tax haul, up from 17 per cent in 2009-10.

Meanwhile, the top 10 per cent of taxpayers - with taxable incomes of more than $105,500 - paid 46 per cent, up from 45.3 per cent a year earlier. The bottom third paid less than 5 per cent in both periods.

The highly and increasingly progressive nature of Australia’s tax burden is clear, but why?

First, income tax becomes more progressive every year without any deliberate change because of what economists call “fiscal drag”. Because the income tax thresholds are fixed in nominal terms and prices tend to rise, every year more taxpayers are pushed into ever-higher tax brackets and larger portions of their real incomes are taxed at higher rates.

Also, most people earn relatively little. While the ABS reports that average annual earnings for individuals were $74,000 a year last May, this figure doesn’t reflect typical circumstances because the “average” is an irrelevant socio-economic metric, increasingly undermined by rare but very large individual incomes. According to the 2011 census, the median household income, which is unaffected by outliers, was only $64,100.

Within advanced countries, the distribution of incomes has become more and more skewed since the 1980s, albeit less rapidly here than in the US and Britain. Economists debate vigorously whether this is because globalisation has boosted the financial returns to innovation, talent and skilled work, or whether the corporate (especially the finance) sector has become more skilled at extracting income at the expense of everyone else (”rent seeking”).

Regardless, burgeoning incomes at the top have given governments a lucrative and politically attractive revenue source. Both major political parties in Australia have been able to promise extra, vote-winning government spending that increasingly overwhelms growth in taxes paid by the vast bulk of the population.

The Labor government’s decision to lift the Medicare levy to 2 per cent from this July to partly pay for the forthcoming disability insurance scheme is a good recent example. For its part, the Coalition wants to impose a temporary “levy” on big companies’ profits (which will reduce dividend income flowing to upper-income earners) to pay for its paid parental leave scheme.

The massive disparity between gross and net payments of tax - 12.6 million people lodged income tax returns in 2010-11 - suggests “churn” is rampant and an immensely complex system is rife for rationalisation: we have more than 100 different taxes across three tiers of government interacting with a multitude of social security services in cash and kind.

The administrative costs of collecting taxes - especially income tax - are large, not to mention the damage they cause to enterprise and effort.

Cutting cash social security along with the first few marginal income tax rates, for instance, would create a more honest tax system and prompt a virtuous cycle of reducing welfare dependency, boosting employment to boot. By converting “in-kind” social security to cash, state governments could provide parents with a voucher to spend on schools administered in the private sector, would help to boost transparency.

Only a tiny share of the population were eligible for the very low rates of income tax that emerged in English-speaking countries in the late 19th and early 20th centuries. While the scope and size of governments have soared since then, the price of civilisation still, rightly, falls disproportionately on the richest.

The distribution of tax is not the problem but its growth as a share of national income is (along with undue focus on income rather than wealth as the determinant of someone’s capacity to pay).

Critics tend to argue that ever-greater taxes drive economic activity overseas and reduce the incentive to work, undermining growth. These are valid arguments but they do not answer the question of what is the most desirable “inequality-economic growth” trade-off.

No number of studies showing that rising tax rates stifle growth, however statistically persuasive, will match glib, emotional arguments that the “rich” can “afford” to pay, so we should make them. The moral case for fixed, reasonable taxesmay resonate more than the pure economic one. Arbitrary increases in taxes to pay for services the market can and should provide offend the rule of law and erode individual property rights.

SOURCE

Lying for the Cause

If myths do more for social "progress" than facts — then why worry?

By Victor Davis Hanson

Well aside from “If you like your doctor you can keep your doctor,” or blanket amnesty that is and is not lawful for a president to grant, there is a special category of progressive mythology. Or rather a particular cast of “truth tellers,” victims, supposed whistle blowers, and popular liberal icons who spin tales for a supposedly higher good, on the premise that untruth for a cause makes it sort of true.

From the details of Rigoberta Menchú’s memoir, to Tawana Brawley’s supposed rape, to the O. J. “If it doesn’t fit, you must acquit” myth, to the open-and-shut case of the hate-crime crucifixion of Matthew Shepard by savage homophobes, to Dan Rather’s fake but accurate National Guard memo, to the Duke lacrosse team’s supposed racist raping, to Barack Obama’s autobiographic interludes with his girlfriend, to Scott Beauchamp’s “true” stories of American military atrocities in Iraq, to Lena Dunham’s purported right-wing sexual assaulter at Oberlin College (home of the 2013 epidemic of pseudo-racist graffiti), to the pack of University of Virginia fraternity rapists on the loose, to “Hands up, don’t shoot,” we have come to appreciate that facts and truth are not that important, if myths can better serve social progress or the careers of those on the correct side of history.

The new generation of progressive mythmaking has taken up where prior generations left off. In the old progressive mythology, Alger Hiss never passed on U.S. secrets. Instead, he was a tortured idealist, intent on preventing the descent of America into dangerous know-nothing McCarthyism. The Rosenbergs really did not spy for the Soviet Union — or if they did, it was to help a wartime ally with a similar anti-fascist agenda. JFK and RFK were gunned down by right-wing conspirators, fueled by a larger culture of reactionary hatred. Rigoberta Menchú wrote her own factual autobiography — or at least wanted to.

Why is there this overarching need to fabricate iconic race, class, gender, and political victims when Western capitalist society supposedly should offer enough pathologies without having to invent any? Many reasons come to mind.

PSYCHODRAMA

One, 21st-century America is not quite the racial cauldron of the 1960s. It is not the 1930s Depression-era world of Steinbeck. And it is not the 1950s straitjacket of housewives all but jailed in tiny suburban boxes. In 2014, the enemy is too much food, not too little, as obesity, not malnutrition and a dearth of calories, is the far more deadly killer of the underclass. More women now graduate from college than do men. Looting an Apple Store or stealing Air Jordans is more common during rioting than carrying off sacks of rice and beans from Costco.

Having an Hispanic last name or being half-African-American is valuable enough in terms of college admission for a middle-class suburbanite to outweigh the dangers of institutionalized racism. Mayor de Blasio’s son, as an African-American male youth, is, in statistical terms, 30 times more likely to die at the hands of an African-American male youth than at the hands of a trigger-happy racist law-enforcement officer. In terms of homicide rates, whites usually murder other whites, as blacks murder other blacks. But in the latter case, 13 percent of the population accounts for over 50 percent of both U.S. murder victims and murder offenders.

A so-called Obamaphone has more computing and entertainment power than the billionaire’s laptop of 20 years ago. In such a diverse, wealthy, and leisured society, it is harder now to find Oliver Twists, Joads, and Nat Turners. With material and social advancement, however, comes not greater appreciation of positive progress, but even more anger at its perceived slow pace, in the march from the desire for equality of opportunity to the demand for government-sanctioned equality of outcome. To paraphrase Tocqueville, most would prefer to be equal and unfree than to be free and unequal. In such a landscape, the perception of relative inequality is a far greater catalyst for anger than the former reality of abject poverty. In other words, the victim status of the past is harder to obtain and thus requires far more creative and fictive methods. What does not exist with enough frequency can at least be invented.

PAINLESS MENDACITY

Two, in the most reductionist sense, there is no downside to lying, if the lie is considered useful for a noble liberal cause. It was the Duke lacrosse players whose lives were ruined, not the professors who wrote public letters condemning them as likely racist rapists. We should expect that if there is something like a Duke baseball scandal at some future date, the same professors would write the same false indictments for the same reasons as they did in the lacrosse case — because there is no liability in weaving a particular sort of tale.

Al Sharpton did not have his business burned down in Ferguson, so why should he worry that he simply turns myths into catalysts for violence? I doubt whether the president of the University of Virginia will be censured for all but equating campus fraternities with endemic rape. It is not as if she said something of the sort that cost Larry Summers his job.

Lena Dunham will probably not be sued, or at least sued in any manner that would deter her from future feminist mythographies. Indeed, she could easily write a sequel at 40 with the same sort of made-up stereotyped conservative villains. Who is going to indict Dorian Johnson for offering false testimony about the death of Michael Brown, or dare tell the Black Caucus that their “Hands up, don’t shoot” theatrics were based on lies? Massaging helpful facts pays; demanding proof for fantasies does not. We live in an age where plagiarism — ask Fareed Zakaria or Doris Kearns Goodwin — is of two sorts: the traditional deliberate theft of someone else’s work for one’s own aggrandizement, and the “problematic” sort, when progressives overwhelmed with data as they strive to give voice to the liberal cause make an inadvertent slip.

WHOSE “TRUTH”?

Three, postmodernism, the bastard child of modernism, attacks the entire idea of objective truth. We supposedly live in a relativist world cloaked by the lie of objective truth. Facts are merely the authoritative narratives of the powerful, who craft them to protect their own privilege. An establishment rigs up “rules of evidence,” and in that way declares its own stories “true” because they serve the larger power purposes of the elite. We should not necessarily be bound by forensic evidence or videos, nor should we check sources or ask the accused their version of the story or check footnotes — or much of anything else other than ascertaining the degree of privilege associated with any particular narrative.

What does it matter if there were not really identifiable University of Virginia fraternity rapists, as Rolling Stone swore? Does anyone doubt that fraternities have treated women poorly in the past? That is the real “truth,” which merely needs a particular “vehicle” to give it currency. Reactionaries call such narratives “fake,” but they are in fact “accurate” in suggesting scenarios of oppression that can in fact happen.

So “truth” is what is deemed socially useful. After the Rolling Stone essay, perhaps frat boys might not be so cavalier about their sexism in the future. The fact that Dan Rather fell for a fake memo is immaterial. If his purpose was to get a regressive like George W. Bush out of the White House, then the means necessary to do that are irrelevant. Maybe Michael Brown did not have his hands up in a gesture of surrender, or then again maybe he did. But who is to rule out that he could have had them up and that the cause of young black males can benefit from assuming that he did? Grand juries worry about irrelevancies like whether bullets hit Brown from the front or the back or whether a particular store owner caught him on tape supposedly stealing; the people, in contrast, deal with the greater “truth” that there are millions of Michael Browns who are victimized by a racist white police architecture.

USEFUL DISTRACTIONS

Four, liberal lies are cheap. They by intent turn attention to easy icons rather than the more difficult and complex paradoxes of the human condition that defy easy sloganeering or cookie-cutter big-government solutions. By iconizing Michael Brown or Trayvon Martin, the black political elite avoids the intractable problem of the violent death of over 6,000 black youths per year, the vast majority killed by other blacks. Blaming stereotyped white racist cops for less than 200 deaths per year serves as an exculpatory salve for not having a clue how to stop the near-genocidal shooting of inner-city young black males. Rich white kids march and scream at police barricades about law enforcement’s supposed racism, but they do not march into the inner city to protest the mass killings of young blacks, or for that matter go into the inner city much at all. What could they do or say, within their own political world views, to help prevent the epidemic of violent death unleashed on young black males?

Al Sharpton can get rich shaking down the establishment with the always implied message that the alternative to his own de facto protection racket is burning stores in Ferguson. Jesse Jackson and Louis Farrakhan have no clue how to restore the black family, create an urban entrepreneurial class, or reduce black illegitimacy and crime rates to the levels of other minority groups. In exasperation, it is simply far easier — and more lucrative — to scream about an impending race war or suggest the grand jury is little more than a Jim Crow–era lynch mob.

The same goes for members of the Obama administration. Eric Holder apparently surmises that if he goes after a local police department, he does not have to investigate the conditions under which Michael Brown thinks he has a right to strongarm a store, slug a policeman, or walk down the center of a highway while under the influence. If Holder went to St. Louis to investigate a spate of hate crimes against Bosnian immigrants, or to learn why youths of color are far more likely to commit than to suffer from interracial crime, he would face existential challenges. Not so if he flies in, cites police racism, and flies out. That gesture becomes penance for an impotence in dealing with the foundational causes of the black underclass — from inordinately high rates of unemployment and incarceration to dismally low rates of graduation and legitimacy.

For these reasons and more, either liberal mythography is not seen as lying, or it is at least more advantageous and more lucrative than the truth. And so we will see more of it.

SOURCE

*************************

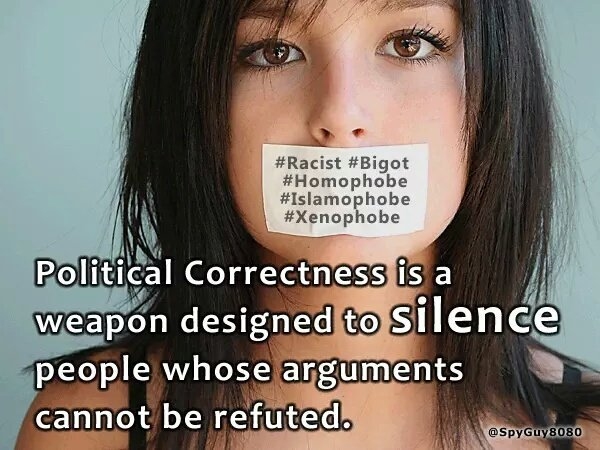

Political correctness is most pervasive in universities and colleges but I rarely report the incidents concerned here as I have a separate blog for educational matters.

American "liberals" often deny being Leftists and say that they are very different from the Communist rulers of other countries. The only real difference, however, is how much power they have. In America, their power is limited by democracy. To see what they WOULD be like with more power, look at where they ARE already very powerful: in America's educational system -- particularly in the universities and colleges. They show there the same respect for free-speech and political diversity that Stalin did: None. So look to the colleges to see what the whole country would be like if "liberals" had their way. It would be a dictatorship.

For more postings from me, see TONGUE-TIED, GREENIE WATCH, EDUCATION WATCH INTERNATIONAL, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS and DISSECTING LEFTISM. My Home Pages are here or here or here. Email me (John Ray) here.

***************************

Subscribe to:

Post Comments (Atom)

/>

/> Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

No comments:

Post a Comment