Friday, April 11, 2014

Whisper it... NO mother wants to work: It'll infuriate feminists

Helena Frith Powell

Two years ago I suddenly found myself, for the first time in my adult life, in a position where I didn’t need to work.

Over dinner one evening my husband, Rupert, announced that he was earning enough money for me to stop working. ‘You could stay at home and look after the children,’ he said, before adding rather nervously, ‘if you want.’

Rupert was right to be apprehensive. What he was suggesting was anathema to everything I’d been brought up to believe in and everything I’d assumed to be right about women’s roles in the 21st century.

As the daughter of a feminist single mother who ran a publishing company, it was drilled into me from a young age that women should be self-sufficient and have high ambitions.

I was led to believe that working was the way you defined who you were and how you justified your existence. Women who didn’t work were, well, not only lazy gold-diggers, but letting the side down.

When people asked me as a child what I wanted to be, my answer was never ‘a rich man’s wife’ or a ‘lady that lunches’. No, I wanted to be a vet, or a writer or, at times, a brain surgeon.

In fact, looking back, I’m not even sure I did really want to be any of those things but like most women of my generation I had been brought up to believe I should work, and what is more, I should want to work.

But now? I wonder if all women don’t secretly long to be in a position where they don’t have to work. Few would admit it, but as I learned myself the truth is that not working not only makes your life more pleasant, it enables you to be a better mother and wife.

As it was, my first response to Rupert was one of utter disbelief. I was the editor of a woman’s magazine. Why on earth would I want to give up a lucrative, apparently dream role? I dismissed his generous offer out of hand.

But the next day I analysed my day in the office and the effect working was having on my life. I no longer had time to exercise. Once I was back from the school-run, going to the gym for half-an-hour hardly seemed worth it.

Each morning I was greeted by my boss whose nickname was (and probably still is, unless she’s grown) the poisoned dwarf. She normally had some irritating comment to make on whatever I was working on.

In the afternoon I had the inevitable, fraught calls from the three children aged between eight and 12 who, once home, were at each other’s throats with only a terrified nanny to separate them.

In the evenings, by the time I had calmed everyone down and listened to their gripes, I was far too exhausted to even have a conversation with my husband. Perhaps I had been a little hasty.

‘You’re on,’ I told Rupert the very next day.

My first day at home a few months later was a revelation. I got up, gave everyone breakfast, took the kids to school, went to the gym, even chatted to a talkative friend I bumped into.

Normally I’d have been so busy and stressed I would have hidden behind my locker so as not to see her and feel obliged to chat. Shockingly, after just one morning, I had turned into one of them.

By them, I mean women who don’t work. Those that I had formerly viewed as the enemy — in part because of my feminist upbringing but also, I now realise, because I was insanely jealous of them.

This is the unspoken truth of why a lot of stay-at-home mums come under attack. It’s not that we working mothers really think they’re inferior — it’s actually that we want to be them.

I firmly believe a lot of working women would jump at the chance to have some time off, a view that’s backed up by figures. This week it was revealed that the hours worked by married women has been steadily dropping over the past 25 years, despite an increase in the range of jobs and levels of pay available to them.

The Government estimates more than a third of working mothers would like to quit their jobs if they could.

Some mums stick to their careers even when they don’t need to because, as Claire, one of my new stay-at-home-mum friends, put it: ‘They would rather be working than looking after their children.’

Claire told me she could always spot which children had mothers who worked and which had mums who didn’t. ‘The ones who have working mothers are so much more fraught,’ she told me. ‘It’s like they’re tight little springs waiting to unravel.’

While before I’d have dismissed her theory out of hand, based on my own experience there is truth in this. When I stopped working, the change in our children was as instantaneous as it was in me.

Suddenly there was laughter in the car on the way to school, a ‘see you this afternoon mummy’ as opposed to an anxious ‘will you be home tonight?’.

The bickering diminished, there was a tranquil atmosphere that hadn’t been there before. I was calmer, so they were calmer.

So wasn’t I worried that I was becoming a nobody? That people wouldn’t take me seriously any more? I remember the first time we went out after my ‘liberation’, as I now call it.

Somebody asked me what I did for a living. I was so shocked I couldn’t answer at first. To say I was a magazine editor was of course no longer true. 'I realised that I was frightened to say I was ‘just a mum’ — but why?'

‘I’m between jobs,’ I replied in the end, sounding like some failed Hollywood actress.

I realised that I was frightened to say I was ‘just a mum’ — but why? Being a mum, as we all know, is actually the hardest job in the world. Even if you have the boss from hell, you can sometimes ignore him (or her). Try ignoring a two-year-old having a tantrum at your peril.

When I was ‘liberated’ my children were eight, 11 and 12 and so I was able to throw myself into trawling round schools with them and prep them for the entrance exams. But, when I wasn’t doing those things, I was doing exactly what I felt like.

This included afternoon naps (almost every day), having my nails maintained by the best in the business and lunching with friends I had previously been too busy to see. Generally my life was much more in order. Instead of running around like a headless chicken yelling at everyone, I was in control of myself, my life and my moods.

We had a kind of equilibrium in our lives I think we had always missed. Looking back on the years when I was working in an office full-time, I would say that at least 70 per cent of arguments and stress were as a result of my having to devote time to work and not the family.

An added bonus was that not only were we happier, but my husband was happier too. He seemed to really enjoy his role as sole provider, perhaps in part because it meant he had more of my attention, just like the children.

Of course it was not always idyllic or perfect — but I’d be lying if I said that him being the provider and me the wife at home didn’t work better than us both working full-time. In fact, it might have worked rather too well.

My diligent tutoring of our children meant that we got them all into the expensive private schools of our choice. So now I have to work to help pay the fees. But, while I might need an income, there’s no way I’m going back into an office full-time.

I’ve set up my own PR company and work from home — when it suits me and my family. And yes, my nails are still perfect.

SOURCE

The way the British taxman is behaving would put Zimbabwe to shame!

Last month’s Budget was warmly greeted in many quarters. Indeed, there was much that was good in it. But George Osborne slipped in one announcement that is arguably the most pernicious measure introduced by a modern-day Chancellor of the Exchequer.

Starting next year, HM Revenue & Customs will be empowered to seize unlimited amounts from the private bank accounts of anyone it believes owes it more than £1,000 in tax.

We are used to banks helping themselves to overdraft charges, or inventing new fees, and swiping our money without even telling us. But hitherto the tax authorities, acting on behalf of government, have not been allowed to ransack our bank accounts.

HMRC has been obliged to respect the rule of law, and apply to magistrates’ courts or county courts, depending on how much money it thinks you owe. Now it will be able to remove cash from your current account — or even your savings — at the flick of a switch.

It’s hard to credit this is happening in our country. In Britain — not in Kazakhstan or Zimbabwe or Russia — the State will be allowed to help itself to what it deems we owe. It is doubly amazing that such a measure should have been rubber-stamped by a Tory Chancellor.

No wonder some observers have questioned the legality of Mr Osborne’s scheme. Frank Haskew, head of the tax faculty at the Institute of Chartered Accountants in England and Wales, has just told the Commons Treasury Committee that it would offend against a ‘fundamental tenet of English law’ that money cannot be ‘grabbed’ from somebody’s account. In other words, it’s illegal.

I can see, of course, that we live in hard times, and that the Treasury is anxious to get every pound of revenue it can lay its hands on in order to reduce our ever-growing national debt. And I accept that there are some dishonest people who don’t pay the taxes they are supposed to.

Pursue them robustly by all means — but not at the expense of sacrificing the precious principle that the State does not have the right to dip its hand into people’s bank accounts without judicial sanction.

Admittedly, there are one or two ‘safeguards’. HMRC is supposed to contact you at least three times about an unpaid tax bill before taking your money, and it can’t confiscate the full amount of what it believes it is owed unless you have at least £5,000 across all your bank accounts.

But the scope for injustice is enormous. Imagine someone who has a legitimate dispute with the tax authorities over a tax bill. Sometimes it is impossible even to get in touch with HMRC to argue the issue, as the National Audit Office has previously complained.

In such cases, HMRC might in future simply take the money before the dispute has been properly debated. Even if the issue has been discussed, the tax authorities might be mistaken in believing they are entitled to a payment. But as judge and jury they will be able to do what they want.

The only recourse for the victim will be to take HMRC to court, or to seek redress with the Tax Adjudicator — a kind of official Ombudsman. In either case, the process could take months, if not years, and almost certainly be traumatic. If lawyers are engaged, it will be expensive, too.

People who may be far from rich could find themselves unjustly fleeced. Money Mail recently reported the case of a £655 demand being sent to a woman who died 12 years ago. HMRC refused to give up the fight even when her daughter explained the situation.

In 2009, Icilda and Hugh Newell, owners of a tiny café in North London, received a preposterous demand for £500,000 in allegedly unpaid taxes and fines. Earlier this year, a judge finally found in their favour. If Mr Osborne’s new scheme had been in force, their bank accounts would doubtless have been arbitrarily plundered.

Money Mail has revealed dozens of examples of vulnerable and elderly taxpayers having complaints about unfair bills wrongly rejected. Last October, a report by the Tax Adjudicator, Judy Clements, laid bare how systematic failings by the taxman have led to thousands of legitimate claims being refused.

In other words, HMRC can often be incompetent as well as ruthless, which should make all of us nervous about the sweeping new powers which a Conservative Chancellor has decided to give it.

There is also little doubt that the tax authorities are happier when hunting down the little people than in taking on the big battalions, as the Commons Public Accounts Committee said last December. Its report pointed out that HMRC has not prosecuted any major internet company over under-payment of tax.

Google paid only £11.6 million in tax in 2012 in this country, despite sales of £3 billion, and profits of nearly £900 million. Amazon dribbled out a derisory £2.4 million in tax on sales of £4.3 billion.

Facebook paid no tax at all — despite making more than £200 million from its UK operations.

And then there are the coffee shops. This week, it emerged Caffe Nero has paid no corporation tax since 2007 on sales of £1 billion. There was an outcry in 2012 when it was revealed profitable Starbucks had paid no corporation tax in three of the previous 14 years. It has since said it will mend its ways.

None of these companies has behaved illegally. They pay only minimal tax in Britain because they are based in Luxembourg or Ireland, where the rates of corporation tax are much lower. Nonetheless, they make whopping profits in this country, and they should be expected to pay their fair share of taxes.

I don’t doubt it is difficult to make these companies (usually American-owned) stump up. But if Mr Osborne were to sit down with his EU counterparts, and come up with a way of forcing these multinationals to pay proper taxes, he would be the most popular man in Britain.

The fact remains that the same HMRC, which hammers small businesses and pensioners, doesn’t have the appetite for confronting multinationals with their armies of accountants and lawyers. It has cut favourable deals with Telecoms giant Vodafone and the American bank Goldman Sachs, sparing them tens of millions of pounds in tax.

On the one hand it is strangely timid, and on the other — where people with no access to tax lawyers and accountants are involved — rapacious. I expect it will empty the bank accounts of some very dodgy characters with its new powers. But it will also terrorise those who have done nothing wrong, and take money to which it is not entitled.

Faced with the largest deficit since the war, George Osborne has been unable to lighten the burden for the great bulk of taxpayers. But surely he remains enough of a Tory to feel disquiet about the prospect of the taxman raiding the private bank accounts of ordinary people.

SOURCE

Immigration to Britain from eastern Europe was massively underestimated, says official report

The number of eastern European migrants who came to Britain in the last decade was hundreds of thousands higher than previously thought, the Office for National Statistics has admitted.

In a disclosure that will fuel intense national concern about immigration, the agency said it had failed to count an estimated 350,000 migrants who arrived in this country between 2001 and 2011.

The ONS said the mistake occurred because it used “inadequate sampling” in a crucial survey at airports which is used to estimate net migration - the difference between the number of people arriving in Britain and those emigrating.

It said most of the migrants who were omitted from the International Passenger Survey (IPS) were from Poland and other former Communist states which joined the European Union in 2004, known as the “EU8” countries.

The revised totals showed net migration over the decade increased from just under 2.2 million to more than 2.5 million.

The ONS’s highest additional number of migrants was for 2006, when net migration is now thought to have been 67,000 higher than previously thought, reaching 265,000.

Original estimates were too low because the ONS concentrated its survey on main airports such as Heathrow but ignored migrants who were arriving on a growing number of budget airline routes into smaller, regional airports, a report said.

“There is evidence that shows the IPS missed a substantial amount of immigration of EU8 citizens that occurred between 2004 and 2008, prior to IPS improvements from 2009,” said the document.

“This is evident from comparisons of IPS data with a number of other data sources related to immigration.

“The EU8 migrants were missed due to IPS interviewing being concentrated at the time at principal airports, such as London Heathrow, London Gatwick and Manchester.

“During this time, many migrants from the EU8 countries were travelling on the increasing number of routes connecting their countries with the UK regional airports. Many of these routes were not covered, or not fully covered, by the IPS for migration purposes prior to 2009.”

The number of children migrating to Britain was also underestimated, it added.

More regional airports were included in the IPS from 2008 but the improvements were “too late to capture the main wave of increased migration” folloring EU expansion in 2004.

Labour, which was in power at the time, has admitted it was wrong not to impose restrictions on eastern Europeans’ ability to come to Britain from 2004.

At the time, official estimates predicted just 15,000 people would come from Poland and the other accession countries but the true figures ran into hundreds of thousands.

The ONS said there was “no evidence” that the passenger survey needed further revisions.

SOURCE

Mock Christians, get laughs, mock Muslims, get bullets

Comment from Australia

A young man mocks Christians on stage on national television he gets laughs. Another young man mocks Muslims on YouTube, he gets bullets through his home's window. Is this the future of religious debate in Australia?

While I won't attempt to edify the erratic rantings of Nathan Abela, a "leader" in the anti-Islamic Australian Defence League who had up to eight bullets fired into his Sydney home last week, it made me ponder the reaction if the same thing had happened to comedian Joel Creasey.

Abela's raison d'etre seems to be to spur a reaction from Muslims, yet his taunts sit in the same ballpark as that of Creasey, who asked the audience during an episode of SBS's Stand Up @ Bella Union last month if anyone was from the Hillsong Christian congregation.

"No-one hoping to have their Guy Sebastian album signed after the gig?" said Creasey, "no, why would you? You guys are great, you guys are awesome, you're out of the house, you're seeing comedy, it's night time. If you were super-religious you'd probably be at home right now, maniacally fisting yourself to Antiques Roadshow."

Funny? I guess it depends on your sense of humour but, the fact Creasey is able to mock Christianity so openly, on a government-funded television station, delights and reassures me I'm living in free, rational society.

Granted, Creasey is telling a gag and Abela's joined the Australian version of the English Defence League - a far-right organisation of violence-prone, Islamophobe hooligans. Yet, he's broken no laws.

Every time I write a column critical of Christianity, a perverse religious solidarity infects some of the more hostile commentors who "dare" me to "say the same things about Islam" - like it's their hot-tempered little brother up the back of the bus.

Islam's sensitivity to criticism is well documented.

American author, philosopher and neuroscientist, Sam Harris, puts it well in his 2010 book The Moral Landscape when he writes: "The peculiar concerns of Islam have created communities in almost every society on earth that grow so unhinged in the face of criticism that they will reliably riot, burn embassies, and seek to kill peaceful people, over cartoons."

"This is something they will not do, incidentally, in protest over the continuous atrocities committed against them by their fellow Muslims. The reasons why such a terrifying inversion of priorities does not tend to maximise human happiness are susceptible to many levels of analysis - ranging from biochemistry to economics.

"But do we need further information in this case? It seems to me that we already know enough about the human condition to know that killing cartoonists for blasphemy does not lead anywhere worth going on the moral landscape," writes Harris.

Neither, would I suggest, does shooting at people if they happen to mock your faith on YouTube.

There is plenty to dislike about all religion - and I've not been shy about my thoughts on the hypocrisies of Christianity. However, to jeer conservative Islam and, as Harris describes, its "demonising homosexuals, stoning adulterers, veiling women, soliciting the murder of artists and intellectuals, and celebrating the exploits of suicide bombers"?

SOURCE

*************************

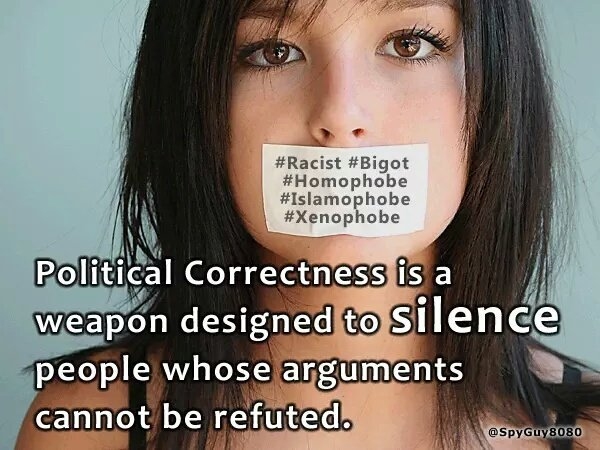

Political correctness is most pervasive in universities and colleges but I rarely report the incidents concerned here as I have a separate blog for educational matters.

American "liberals" often deny being Leftists and say that they are very different from the Communist rulers of other countries. The only real difference, however, is how much power they have. In America, their power is limited by democracy. To see what they WOULD be like with more power, look at where they ARE already very powerful: in America's educational system -- particularly in the universities and colleges. They show there the same respect for free-speech and political diversity that Stalin did: None. So look to the colleges to see what the whole country would be like if "liberals" had their way. It would be a dictatorship.

For more postings from me, see TONGUE-TIED, GREENIE WATCH, EDUCATION WATCH INTERNATIONAL, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS and DISSECTING LEFTISM. My Home Pages are here or here or here. Email me (John Ray) here.

***************************

Subscribe to:

Post Comments (Atom)

/>

/> Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

No comments:

Post a Comment